Bikemounts.nl opmaat gemaakte houders voor bikeradars, fietscomputers & tools. Perfect passend op JOUW fiets.

https://twitter.com/ZachHonig/status/1140607586531708928

Voor aziaten is het waarschijnlijk prima. Voor Amerikanen echter...XWB schreef op dinsdag 18 juni 2019 @ 00:27:

AirAsia X heeft zijn eerste A330neo in Parijs onthuld. Het is één van de weinige A330 klanten met een 9-abreast cabin (8-abreast is standaard), dus mocht iemand zich afvragen hoe dat eruit ziet:

[Afbeelding]

https://twitter.com/ZachHonig/status/1140607586531708928

Moderne produktontwikkeling. Zoals Reid Hoffmann (LinkedIn) ooit zo treffend zei: "if you're not embarrassed by the first version of your product you've launched too late"wildhagen schreef op zondag 16 juni 2019 @ 08:00:

Je kan je onderhand afvragen of de QA bij Boeing door de (achter)kleinzoon van de CEO wordt gedaan vanuit zijn zandbak....

Flightradar link

/post

Op 6 juli kun je op vliegbasis Woensdrecht het nieuwe regeringstoestel PH-GOV bekijken. Aanmelden vanaf 14.00 uur mogelijk via https://t.co/oeWsJx1ttG #PHGOV pic.twitter.com/DDTkSDnzTB

— Ministerie van Infrastructuur en Waterstaat (@MinIenW) 18 juni 2019

De aanmeldtermijn voor het publiek sluit uiterlijk op 29 juni, of wanneer alle beschikbare 3000 plaatsen gereserveerd zijn. Aanmelding is gezien de veiligheidsmaatregelen op de vliegbasis verplicht.

[ Voor 54% gewijzigd door Cheesy op 18-06-2019 09:11 ]

Toch mooi dat we die man z'n hobby sponsoren!Sand0rf schreef op dinsdag 18 juni 2019 @ 08:46:

Vandaag is de afleveringvlucht van de PH-GOV vanuit Charleston naar Woensdrecht. Naar het schijnt zit Willem Alexander zelf in de cockpit om hem naar huis te vliegen.

Flightradar link

Bikemounts.nl opmaat gemaakte houders voor bikeradars, fietscomputers & tools. Perfect passend op JOUW fiets.

Hoezo sponsoren? Het scheelt, op deze vlucht, in ieder geval een betaalde piloot..GoldenSample schreef op dinsdag 18 juni 2019 @ 09:32:

[...]

Toch mooi dat we die man z'n hobby sponsoren!

https://twitter.com/cassidysvacay/status/1140090317850521601

Eh, een piloot die opleiding moet doen, die niet of nauwelijks commerciële vluchten maakt en dus geen geld oplevert. Ik vind het prima dat de koning lekker vliegt maar het is wel gewoon een hobby sponsoren.Fly-guy schreef op dinsdag 18 juni 2019 @ 09:40:

[...]

Hoezo sponsoren? Het scheelt, op deze vlucht, in ieder geval een betaalde piloot..

F-WZFN Airbus A350 Air France by @Eurospot, on Flickr

Ik ben zelf ook wel eens een beetje decadent, maar dit

Hij gaat toch vliegen voor de KLM? Dat doet hij onbezoldigd. Ik gok dat de KLM hem ook zelf heeft opgeleid. Denk niet dat de samenleving hier echt geld mee kwijt is.PolarBear schreef op dinsdag 18 juni 2019 @ 11:36:

[...]

Eh, een piloot die opleiding moet doen, die niet of nauwelijks commerciële vluchten maakt en dus geen geld oplevert. Ik vind het prima dat de koning lekker vliegt maar het is wel gewoon een hobby sponsoren.

[ Voor 49% gewijzigd door PWM op 18-06-2019 11:47 ]

Ik vraag me af wat die kist in Charleston had te zoeken.Sand0rf schreef op dinsdag 18 juni 2019 @ 08:46:

Vandaag is de afleveringvlucht van de PH-GOV vanuit Charleston naar Woensdrecht. Naar het schijnt zit Willem Alexander zelf in de cockpit om hem naar huis te vliegen.

Flightradar link

Zal wel een belasting ding zijn of een of andere formaliteit...

En via Air Lease Corporation ALC is nog een extra 787-10 besteld. KLM ontvangt dus nu minimaal 9 787-10's, maar dit kunnen er nog meer worden.XWB schreef op dinsdag 18 juni 2019 @ 11:22:

Ander nieuws uit Charleston is de eerste KLM 787-10 dat inmiddels zijn eerste vlucht gemaakt heeft:

[Afbeelding]

[Afbeelding]

https://twitter.com/cassidysvacay/status/1140090317850521601

Papierwerk en certificering van het interieur vanuit BoeingPiet91 schreef op dinsdag 18 juni 2019 @ 11:53:

Ik vraag me af wat die kist in Charleston had te zoeken.

Zal wel een belasting ding zijn of een of andere formaliteit...

/post

Tevens is de eerste vlucht van de 777X nu met een half jaar vertraagd door problemen met de motor.Giant Gulf airline Emirates, the carrier with the world’s largest widebody aircraft fleet and the clout to go with it, is in negotiations with Boeing that could substantially defer part of its massive order for 150 Boeing 777X jets and perhaps replace some with smaller 787 planes.

Emirates president Tim Clark confirmed in an interview Saturday that the 777X renegotiation is approaching conclusion, though the outcome likely won’t be announced until the Dubai Air Show in the fall.

The airline represents nearly half the firm orders for the new widebody jet.

Door een probleem met de nieuwe GE9X-motor duurt het een half jaar langer voor de eerste Boeing 777-9 de lucht in kan. Dat heeft General Electric-topman David Joyce maandag gezegd. De maiden flight wordt nu aan het eind van dit jaar verwacht.

Boeing heeft er ondanks het uitstel nog steeds vertrouwen in dat de eerste 777-9 volgend jaar geleverd kan worden, voegde Kevin McAllister daaraan toe. Hij is de CEO van Boeing's commerciële vliegtuigendivisie. Beide directeuren waren maandag op de Paris Air Show.

VOLKEL - Een van de twee Nederlandse F-35's die meedeed aan de Luchtmachtdagen is met een technisch mankement achtergebleven op de vliegbasis Volkel. Er is een probleem met de motor en daarvoor moeten onderdelen uit Amerika worden overgevlogen. ,,Er wordt hard aan gewerkt maar het is niet te zeggen of de F-35 hier nog dagen of weken zal staan”, zegt woordvoerder André Bongers van de vliegbasis Volkel.

[...]

De selectie procedure en de daarvoor al bekende omscholing van Wim-Lex is een typisch geval van 'wel heeeeeeeel toevallig'Fly-guy schreef op dinsdag 18 juni 2019 @ 09:40:

[...]

Hoezo sponsoren? Het scheelt, op deze vlucht, in ieder geval een betaalde piloot..

- hij vind het belangrijk zelf te blijven vliegen

- hij werd al omgeschoold naar 737 voor het regeringsvliegtuig besluit/selectie gedaan was (geheel nieuwe type rating & brand ook

- biedingen in de aanbesteding besteding bleken allemaal 'ongeldig', bod van Airbus leek veel beter dan dat van Boeing

- Na ongeldige bediedingen is er onderhands gegund op basis van andere criteria/eisen

- erg weinig informatie is openbaar gemaakt (niet heel vreemd) ook niet na politieke gevoeligheid is er niet meer (al dan niet binnen een deel van de kamer) gedeeld (wel vreemd)

Op z'n zachtst gezegd zou meer openheid wenselijk zijn om de vreemde geur bij het verhaal te laten verwaaien. Heb net wat te veel tenders gezien..

Bikemounts.nl opmaat gemaakte houders voor bikeradars, fietscomputers & tools. Perfect passend op JOUW fiets.

- Gebruik maken van de pool aan 737 piloten van de KLM en eventueel TUI

- Het onderhoud van de PH-GOV door KLM laten doen

Het was netter geweest van de overheid om gewoon te zeggen waarom ze voor Boeing kiezen maar ik snap de keuze wel.

/post

Fokker doet gewoon (groot) Airbus onderhoud op Woensdrecht, dus dat zal geen probleem zijn. Daarnaast zijn er meerdere bedrijven die line maintenance doen op Schiphol. KLM zelf zal dat absoluut ook kunnen.Sand0rf schreef op dinsdag 18 juni 2019 @ 15:12:

Kijk dat je op je kon aanvoelen dat het de BBJ werd toen de Koning zijn 737 typerating ging halen wist je ook wel maar bij de aanschaf van een vliegtuig is buiten de aanschafprijs het onderhoud en crew misschien nog wel net zo belangrijk. Door voor een 737 te kiezen kan je:Als je een Airbus had gekozen (omdat die Europees is) had je voor elke onderhoudsbeurt het vliegtuig naar het buitenland (Frankrijk denk ik dan) moeten sturen en een aantal piloten in dienst moeten nemen die 24/7 klaar staan om naar elke uithoek van de wereld te vliegen. Als je even uitgaat van een cockpitbemanning van 3 man (vanwege transcon vluchten) zijn dat heel wat manuren die je speciaal voor dit ene toestel moet betalen.

- Gebruik maken van de pool aan 737 piloten van de KLM en eventueel TUI

- Het onderhoud van de PH-GOV door KLM laten doen

Het was netter geweest van de overheid om gewoon te zeggen waarom ze voor Boeing kiezen maar ik snap de keuze wel.

Dat het een 737 geworden is verbaasde me niks, in NL heeft men niet zoveel met Airbus. Ze zullen het alleen niet hardop zeggen.

Ik bespeur hier een zekere mate van onethische logica.

Je kunt TCO toch als onderdeel van je tender meenemen? En als in de TCO zit dat je een paar crews op A320 moet scholen en standby moet hebben tegenover vrijwel direkt kunnen kiezen uit een hele vloot 737 vliegers, dan hoef je toch helemaal niet geheimzinnig te doen? Als een A320 dan toch goedkoper blijkt, so be it. Maar ik betwijfel dat ook.GoldenSample schreef op dinsdag 18 juni 2019 @ 15:01:

[...]

- biedingen in de aanbesteding besteding bleken allemaal 'ongeldig', bod van Airbus leek veel beter dan dat van Boeing

- Na ongeldige bediedingen is er onderhands gegund op basis van andere criteria/eisen

- erg weinig informatie is openbaar gemaakt (niet heel vreemd) ook niet na politieke gevoeligheid is er niet meer (al dan niet binnen een deel van de kamer) gedeeld (wel vreemd)

Signatures zijn voor boomers.

Zover ik gelezen heb komt dit nogal vaak voor.Cheesy schreef op dinsdag 18 juni 2019 @ 14:35:

Ik vroeg me al af waarom er maar 1 F35 mee deed in de Air Power demo. De F-001 staat namelijk vanaf aankomst met een defect aan de grond.

[...]

Las laatst een artikel over de F35s die al actief zijn in de VS en het percetage dat ze inzet bereid zijn is bizar laag.

https://www.thedrive.com/...than-five-percent-of-time

ZIjn ook steeds meer stemmen om de F-22 weer in productie te nemen of om de F-15 een giga upgrade te geven.

[ Voor 9% gewijzigd door Deadsy op 18-06-2019 18:19 ]

Nee dat verbaast mij ook niet. We kijken, ook voor de luchtmacht, nog steeds vooral naar Amerikaanse toestellen omdat de Amerikanen 60 jaar geleden voor ons klaar stonden. Hoe goed de rest ook is op papier. Er zal Amerikaans gekozen worden.Bolk schreef op dinsdag 18 juni 2019 @ 15:29:

Dat het een 737 geworden is verbaasde me niks, in NL heeft men niet zoveel met Airbus. Ze zullen het alleen niet hardop zeggen.

There's no need to kneel, I'm a very democratic sort of lord.

Daarom worden de KDC-10's van de luchtmacht ook opgevolgd door Airbus A330 multi role tanker-transportvliegtuigen.LordSinclair schreef op dinsdag 18 juni 2019 @ 18:43:

[...]

Nee dat verbaast mij ook niet. We kijken, ook voor de luchtmacht, nog steeds vooral naar Amerikaanse toestellen omdat de Amerikanen 60 jaar geleden voor ons klaar stonden. Hoe goed de rest ook is op papier. Er zal Amerikaans gekozen worden.

Wat betreft de F35, als je naar de politieke eis kijkt van een toestel dat 40 jaar in dienst moet kunnen zijn, inclusief updates, levergarantie van onderdelen, etc., dan is de keuze voor een toestel dat in grote aantallen door de grootste NAVO-partner wordt besteld verstandiger dan de Europese alternatieven. Of het operationeel ook een verstandig besluit is kunnen we alleen afwachten.

Denk dat AF meer naar Airbus dan naar Boeing neigt, terwijl dat bij de KLM juist andersom is.Thetallguy schreef op dinsdag 18 juni 2019 @ 22:17:

Letter of Intent (nog lang geen order maar oké) van IAG voor 200x 737Max, dat is interessantBenieuwd wat AFKL nog gaat doen deze week.

Hoop dat de KLM ook zo'n mooie Boeing order weet te scoren. Daar zijn nu mooie kortingen te bedingen.

If buying doesn’t mean ownership Then pirating isn’t stealing / iRacing Profiel

wat ook een rol speelde was dat de Nederlandse industrie er ook iets aan zou hebben.Waaj schreef op dinsdag 18 juni 2019 @ 21:21:

[...]

Daarom worden de KDC-10's van de luchtmacht ook opgevolgd door Airbus A330 multi role tanker-transportvliegtuigen.

Wat betreft de F35, als je naar de politieke eis kijkt van een toestel dat 40 jaar in dienst moet kunnen zijn, inclusief updates, levergarantie van onderdelen, etc., dan is de keuze voor een toestel dat in grote aantallen door de grootste NAVO-partner wordt besteld verstandiger dan de Europese alternatieven. Of het operationeel ook een verstandig besluit is kunnen we alleen afwachten.

De keuze qua toestellen waar je x aantal jaren mee vooruit kunt waren ook vrij beperkt.

Airbus zou een eigen toestel kunnen maken maar dan loop je weer stuk op dat de Fransen het willen kunnen exporteren aan elk land en de Duitsers niet.

Jammer dat de Britten hun industrie zo kapot gemaakt hebben en geen toestellen meer maken.

[ Voor 19% gewijzigd door Deadsy op 18-06-2019 22:51 ]

Klopt, als er dan toch miljarden aan belastinggeld wordt uitgegeven probeert men zoveel mogelijk van dat geld terug te krijgen in de eigen economie. Dat is dus (terecht) een afweging.Deadsy schreef op dinsdag 18 juni 2019 @ 22:49:

[...]

wat ook een rol speelde was dat de Nederlandse industrie er ook iets aan zou hebben.<>

franssie.bsky.social | 🎸 Niets is zo permanent als een tijdelijke oplossing | Een goed probleem komt nooit alleen | Gibson guitar Fender Guitar God Damn Guitar

Ja. Staat hier o.a. https://www.cbsnews.com/n...eadly-crashes-2019-06-18/Thetallguy schreef op dinsdag 18 juni 2019 @ 22:17:

Letter of Intent (nog lang geen order maar oké) van IAG voor 200x 737Max, dat is interessantBenieuwd wat AFKL nog gaat doen deze week.

Ik vond dit wel interessant.

Ik vraag me af hoeveel korting IAG heeft weten te bedingen om als eerste weer een (voorlopig nog 'theoretische') order voor de Max te plaatsen. Hoe ver zou Boeing hebben willen gaan om dat bericht de wereld in te kunnen sturen tijdens de PAS?.The letter is subject to final agreement but is a vote of confidence in Boeing as it struggles to win back trust. The planes would be delivered between 2023 and 2027 to airlines owned by IAG. The combination of 737-Max 8 and 737-Max 10 planes would cost $24 billion at list prices, though companies usually strike deals for discounts.

«Given the scale of our operations, I see no reason why we should confine ourselves to Airbus. There seems to be an impression that we will always be a pure Airbus operator. But that is not healthy. There has to be competition between aircraft manufacturers», Walsh explains. He adds he means that «very seriously». How serious? «It’s also not the first time we’ve thought about this. In 2012 we had considered switching the Vueling fleet from Airbus to Boeing», says Walsh. At that time, however, it had been concluded that the impact on operations had been too great.

Oftewel, de korting was zo hoog je zou gek zijn als je het niet deed.XWB schreef op dinsdag 18 juni 2019 @ 23:33:

IAG weet ook wel dat de 737 Max problemen opgelost zullen worden. De voornaamste reden voor de bestelling:

[...]

- American Airlines: 50 stuks

- Indigo Parnters (waaronder WizzAir o.a. valt): 50 stuks

- Qantas: 36 stuks

- IAG (voor Iberia en Aer Lingus): 14 stuks

- Middle East Airlines: 4 stuks

- Cebu Pacific: 10 stuks

- ALC (leasebedrijf): 27 stuks (launch customer)

Nu dus al 191 orders, en de Paris Air Show is nog niet voorbij. En dat terwijl het toestel nog niet eens een meter gevlogen heeft of zelfs maar gebouwd is

Boeing kan het zo met zijn eventuele 797 wel schudden denk ik

Sowieso zie ik opvallend weinig Boeings verkocht worden op de show tot nu toe, en de paar die er verkocht worden zijn vaak freighter (veel 777F's, paar 737F's).

Airbus doet wel heel goede zaken tot nu toe, net als Embraer en ATR.

Virussen? Scan ze hier!

KLM has committed to taking up to 35 Embraer 195-E2 jets for its Cityhopper regional unit, completing a multi-year campaign for a new aircraft.

The Dutch carrier has signed a letter of intent covering 15 firm E195-E2s plus purchase rights for another 20, in a deal worth $2.48 billion at list prices. Deliveries of the firm aircraft will run from 2021 through 2023.

Met een order van 24 miljard 'list price' heeft Boeing hoeveel van zijn beurswaarde hersteld? Hoe belangrijk dit is wordt ook mooi geïllustreerd door het belang voor een grote toeleverancier.While markets were on the rise overall Tuesday amid news of planned trade talks between the U.S. and China, the Boeing Co. rode a jolt of good news for its 737 MAX to an even higher gain in afternoon trading.

Boeing (NYSE: BA) was up 5.1 percent to $372.97 following an announcement from the Paris Air Show that International Airlines Group had signed a letter of intent for 200 737 MAX jets.

The order will be worth $24 billion at list prices if finalized, though such customers typically receive large discounts from the advertised costs.

IAG is the parent company of Aer Lingus, British Airways, Iberia, Vueling and LEVEL airlines.

The deal was much-needed good news for the 737 MAX, which remains grounded following two deadly crashes of the jet in five months.

Boeing continues to work with regulators to return the narrow-body aircraft to service, though a firm timetable for that return remains unknown.

“We’re very pleased to sign this letter of intent with Boeing and are certain that these aircraft will be a great addition to IAG’s short-haul fleet,” IAG CEO Willie Walsh said in a press release. “We have every confidence in Boeing and expect that the aircraft will make a successful return to service in the coming months having received approval for regulators.”

While still not a firm order, the positive intention from such a major customer was a much-needed boost for the MAX that was in turn a positive sign for aerospace manufacturing industry in Wichita.

Spirit AeroSystems Inc. (NYSE: SPR), the city’s largest employer and builder of 70 percent of the structure on the 737 for Boeing, was up 3.2 percent to $82.24 following the order announcement.

The 737 program, driven primarily by the MAX variant, accounts for around half of Spirit's annual sales.

Er lijkt maar geen einde te komen aan de quality control issues met de KC-46 tanker. Blijkbaar is dit een cultuurprobleem binnen Boeing:XWB schreef op dinsdag 2 april 2019 @ 22:59:

Boeing lijkt een quality control issue met de nieuwe KC-46 tanker te hebben. De US Air Force heeft de leveringen daarom tijdelijk stopgezet.

[...]

Het komt wel vaker voor dat items tijdens assembly in het vliegtuig blijven liggen. Daarom hebben Boeing en Airbus zogenaamde quality control inspectors, maar kennelijk is er bij de KC-46 leveringen iets niet helemaal goed gegaan.

De nieuwe tanker loopt al twee jaar achter op schema en is naar schatting $3 miljard over budget. Daarnaast is de eerste batch KC-46 tankers nog niet in staat om vliegtuigen bij te tanken, omdat de zogeheten refueling pods pas in 2020 gecertificeerd zullen worden.

The US Air Force (USAF) continues to find foreign object debris (FOD) inside the Boeing KC-46A Pegasus in-flight refuelling tanker, including loose material found this week, and it expects to discover objects for the foreseeable future.

FOD found inside new KC-46As delivered to the USAF is a result of cultural problems, said Will Roper, USAF assistant secretary of the air force for acquisition, technology and logistics, at the show. The service is finding tools, rubbish and left-over parts such as loose nuts during inspections, he said.

“It’s a cultural issue,” says Roper. “We are having those cultural dialogues with Boeing. This is not something you fix by sending out a memo, and then there’s no foreign object debris in the airplanes.”

The problem of FOD within the KC-46A is not likely to be fixed soon, he adds.

As a result of additional inspections, the USAF is accepting aircraft at a pace of about one per month – less than the three per month that was planned. Boeing had planned to deliver 36 aircraft to the USAF in 2019, but thus far has delivered just 11 jets, said Roper.

Boeing 777-9 N779XW by Royal King, on Flickr

De eerste vlucht laat nog een half jaartje op zich wachten, omdat een deel van de nieuwe GE9X motor een redesign nodig heeft.

[ Voor 11% gewijzigd door XWB op 21-06-2019 00:21 ]

Ik zal het waarschijnlijk veel te simpel voorstellen, maar hoe moeilijk kan het zijn ervoor te zorgen dat er geen los materiaal , onderdelen en gereedschap achterblijft in een toestel?XWB schreef op donderdag 20 juni 2019 @ 00:35:

[...]

Er lijkt maar geen einde te komen aan de quality control issues met de KC-46 tanker. Blijkbaar is dit een cultuurprobleem binnen Boeing:

[...]

Loop voor het vliegtuig klaar is met wat sterke magneten het vliegtuig op en af (elektronica moet wel volledig uitstaan natuurlijk), dan heb je 95% waarschijnlijk al te pakken.

Indien er een mogelijkheid is voor een onderschrift, dient deze getoond te worden.

En moet je die enorme folding wingtips zien, toch weer iets groter dan de 767 winglets:

Vanmorgen op Frankfurt:

Lees her en der dat de sleeper een hartaanval zou hebben gehad.

[ Voor 56% gewijzigd door Piet91 op 21-06-2019 00:51 ]

Vooropgesteld dat het zeker goede zaken zijn: een groot deel van deze orders is conversies van bestaande orders (voor zover ik het goed onthouden heb, veel A321LR's die omgezet zijn naar XLR's).wildhagen schreef op woensdag 19 juni 2019 @ 16:37:

Volgens mij doet Airbus goede zaken met die A321XLR, al aardig wat orders op de Paris Air Show....

Verwijderd

https://www.omroepbrabant...r-vliegtuig-bij-Oudemolen

De PH-VCY is op z'n kop in een sloot zijn gecrashed, 2 inzittende overleden), de andere (PH-RED) heeft in een veld een noodlanding gemaakt. Die inzittenden zijn oké.

[ Voor 30% gewijzigd door Verwijderd op 21-06-2019 14:08 ]

Twee doden in dat andere vliegtuigje volgens diverse nieuwsmedia...Verwijderd schreef op vrijdag 21 juni 2019 @ 13:25:

Twee sportvliegtuigen hebben elkaar geraakt boven Oudemolen (NB) bij een mislukte formatie vlucht.

https://www.omroepbrabant...r-vliegtuig-bij-Oudemolen

Het lijkt er op dat om de PH-VTA gaat:

https://www.flightradar24.com/data/aircraft/ph-vta#20fa79f5

En mogelijk om de PH-VCY (deze zou op z'n kop in een sloot zijn gecrashed, 2 inzittende overleden), de andere heeft in een veld een noodlanding gemaakt. Die inzittenden zijn oké.

[Afbeelding]

Niet alle schroeven en bouten zijn magnetisch.Maarten_E schreef op vrijdag 21 juni 2019 @ 00:24:

[...]

Ik zal het waarschijnlijk veel te simpel voorstellen, maar hoe moeilijk kan het zijn ervoor te zorgen dat er geen los materiaal , onderdelen en gereedschap achterblijft in een toestel?

Loop voor het vliegtuig klaar is met wat sterke magneten het vliegtuig op en af (elektronica moet wel volledig uitstaan natuurlijk), dan heb je 95% waarschijnlijk al te pakken.

I hide at work because good employees are hard to find.

https://nos.nl/artikel/22...jes-in-noord-brabant.html

Er kan natuurlijk ook een technische stoornis in het spel zijn maar ik vrees dat men de moeilijkheidsgraad van het formatievliegen wellicht onderschat heeft en het eigen kunnen heeft overschat.

Met wat gebroken botten was de boodschap ook wel overgekomen maar helaas hebben ze er dan zo achter moeten komen.

Bron: https://www.luchtvaartnie...-van-vallende-fokker-f-28NASA heeft videobeelden vrijgegeven van een Fokker F-28 die vanaf enkele tientallen meters omlaag valt. Dat gebeurde in het kader van een crash test op het Impact Research Facility (LandIR) in Langley. Aan boord van het in Nederland gebouwde vliegtuig zaten 24 crash test dummies.

De F-28, de voorloper van de Fokker 70/100, is het grootste vliegtuig dat ooit op LandIR is gedropt. De test diende om informatie te verzamelen over vliegtuigongelukken.

In het toestel waren tal van camera’s geplaatst. De verzamelde gegevens zullen gebruikt worden in computersimulaties die moeten bijdragen aan een hogere veiligheid.

Op de vrijgegeven beelden is te zien dat de F-28 vanaf een stellage wordt losgelaten, kort 'zweeft' en met een harde klap op een zanderige ondergrond terechtkomt. Daarbij breken de vleugels af maar blijft de romp op het oog grotendeels intact.

Bij de test werkte NASA samen met de Amerikaanse luchtvaartautoriteit FAA, het Amerikaanse leger en de National Transportation Safety Board.

In het artikel staan ook wat Twitter-filmpjes. Youtube heeft er ook een filmpje van:

[YouTube: NASA's full-scale crash test of Fokker F-28 airplane]

Bron: https://www.luchtvaartnie...-airbus-a320s-op-schipholDe Onderzoeksraad voor Veiligheid (OVV) is een onderzoek gestart naar een bijna-botsing tussen twee Airbus A320’s op Schiphol. Het incident vond op 3 februari plaats op de grond. De OVV heeft het voorval geclassificeerd als ‘ernstig incident’.

Een Airbus A320 landde in de avond op baan 18C en kreeg toestemming van de luchtverkeersleiding via taxibaan Q (Quebec) naar de parkeerpositie aan de C-pier te taxiën. De bemanning kreeg tevens de instructie om bij het naderen van taxibaan Q eerst voorrang te verlenen aan een andere Airbus A320 die van rechts naderde via taxibaan Z (Zulu).

De bemanning van deze A320 kreeg te horen dat de (zojuist gelande) A320 op hen zou wachten. Beide toestellen naderden elkaar bij de kruising van beide taxibanen. De bemanning van de gelande A320 verleende echter geen voorrang, waardoor de bemanning van de andere A320 genoodzaakt was een noodstop te maken.

Beide toestellen passeerden elkaar volgens de OVV op korte afstand.

Virussen? Scan ze hier!

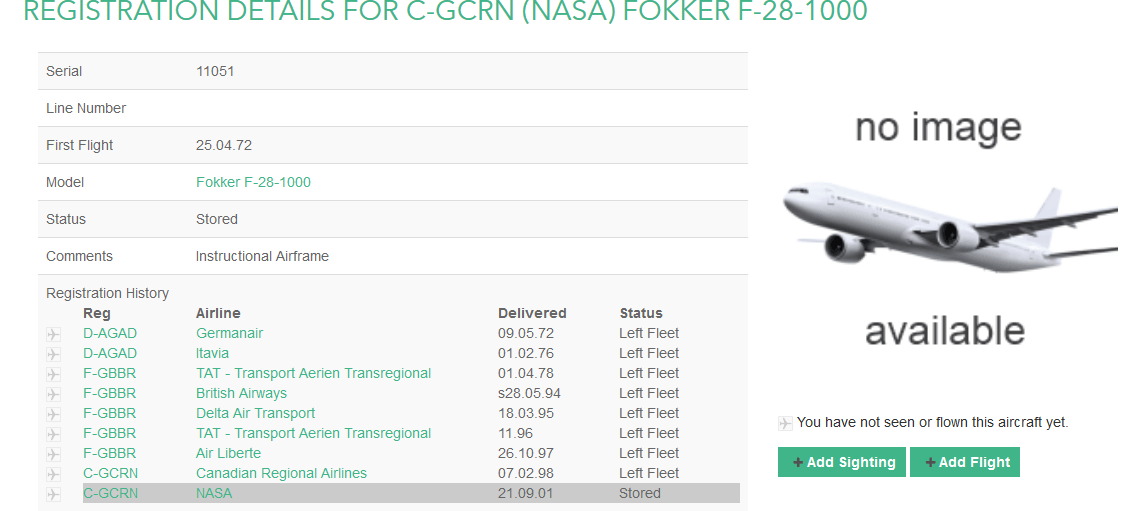

Haha, niet eens gezien. De echte registratie van dit toestel was overigens C-GCRN.easyriider schreef op vrijdag 21 juni 2019 @ 16:09:

Het registratienummer van deze Fokker wat te zien is op het filmpje is C-RASH

Kist heeft dus aardig lange carriere gehad, en vooral in Frankrijk rondgevlogen.

Virussen? Scan ze hier!

Zover ik gelezen heb zijn het vooral deeltjes aluminium, dus dan ga je met een magneet niet veel verder komen.Maarten_E schreef op vrijdag 21 juni 2019 @ 00:24:

[...]

Ik zal het waarschijnlijk veel te simpel voorstellen, maar hoe moeilijk kan het zijn ervoor te zorgen dat er geen los materiaal , onderdelen en gereedschap achterblijft in een toestel?

Loop voor het vliegtuig klaar is met wat sterke magneten het vliegtuig op en af (elektronica moet wel volledig uitstaan natuurlijk), dan heb je 95% waarschijnlijk al te pakken.

Er zou ook gereedschap aangetroffen zijn.

Dat laatste is een teken dat er echt iets fout zit op de werkvloer, bij een simpele inspectie voordat men het gedeelte afsluit zou dit toch wel zichtbaar moeten zijn. Maar blijkbaar vinden deze niet plaats.

Maar dat er deeltjes aluminium achterblijven is ook al een teken dat er iets niet goed gaat qua kwaliteits controle.

Mijn vader werkt niet in de luchtvaart ofzo maar werkt wel eens aan machines op plekken waar strenge regels zijn van hoe je de werkplek achter laat etc.

En stukjes metaal achter laten wanneer de inspectie is betekend gewoon dat je een waarschuwing te pakken hebt.

Gevoel dat deze dingen bij Boeing achterwege gelaten worden vanwege de kosten of werk druk.

Zolang er zelfs op de operatietafel dit soort fouten gemaakt worden (wel steeds minder gelukkig) verbaas ik mij nergens over.Deadsy schreef op vrijdag 21 juni 2019 @ 16:36:

[...]

Zover ik gelezen heb zijn het vooral deeltjes aluminium, dus dan ga je met een magneet niet veel verder komen.

Er zou ook gereedschap aangetroffen zijn.

Dat laatste is een teken dat er echt iets fout zit op de werkvloer, bij een simpele inspectie voordat men het gedeelte afsluit zou dit toch wel zichtbaar moeten zijn. Maar blijkbaar vinden deze niet plaats.

Maar dat er deeltjes aluminium achterblijven is ook al een teken dat er iets niet goed gaat qua kwaliteits controle.

Mijn vader werkt niet in de luchtvaart ofzo maar werkt wel eens aan machines op plekken waar strenge regels zijn van hoe je de werkplek achter laat etc.

En stukjes metaal achter laten wanneer de inspectie is betekend gewoon dat je een waarschuwing te pakken hebt.

Gevoel dat deze dingen bij Boeing achterwege gelaten worden vanwege de kosten of werk druk.

Ook maintenance staff van operators doet dit overigens wel eens hoor, dus het is echt niet beperkt tot Boeing mannen/vrouwen. Zo zag ik mid-flight eens een moersleutel liggen toen de spoilers omhoog gingen. Not a pretty sight

It's Difficult to Make Predictions - Especially About the Future

Een nationale luchtvaartautoriteit mag dat voor hun nationale luchtvaartmaatschappijen beslissen. Alleen Iran kan het luchtruim sluiten voor alle maatschappijen.SRich schreef op vrijdag 21 juni 2019 @ 19:14:

Ff een vraagje hoe kan de FAA bepalen dat er niet meer in het luchtruim van iran gevlogen mag worden?

WEES BLIJ !!! Hier had uw advertentie kunnen staan...

Surinam Airways kiest nu toch voor de Boeing 777-200ER als opvolger van hun A340. Weliswaar tijdelijk, want uiteindelijk willen ze dus een 787 gaan aanschaffen.gop1 schreef op dinsdag 3 juli 2018 @ 22:03:

Van de huidige Airbus A340-313 van Surinam Airways loopt het leasecontract tot eind 2019, evenals het 4-jarige totaalonderhoudscontract bij Lufthansa Technik.

Als het goed is zijn ze momenteel bezig met het verkrijgen van ETOPS-certificaten.

Ik hoop dat ze dat (op tijd) lukt, want dan zou dit zomaar eens een perfecte opvolger voor ze kunnen zijn:

[Afbeelding]

Dit toestel is akomstig van China Eastern (ex-lease) en is sinds vandaag opgeslagen in Cardiff en weer beschikbaar voor lease.

Ten opzichte van de huidige A340-313 heeft deze A330-243 bijna alleen maar voordelen, namelijk:

- 12 jaar en 4 maanden oud, meer dan 7 jaar jonger.

- Een lager eigen gewicht van zo'n 11 ton.

- Met twee motoren minder toch 28 kN extra stuwkracht.

- Bij de huidige indeling 266 stoelen, 51 minder dan de a340, maar dat betekent dat de bezettingsgraad beter wordt.

- De Betalende lading is slechts 2,6 ton minder.

- Lager brandstofverbruik

- Betere performance (niet dat ze die nodig hebben op Schiphol of Zanderij, maar goed).

Ze waren (of zijn) zelf aan het kijken naar een 777-200, maar dat lijkt me wat te groot, zwaar en duur voor ze. Bovendien zouden ze dan andere piloten moeten aannemen of hun huidige piloten (en ander personeel) moeten omscholen.

Zie https://www.luchtvaartnie...est-voor-boeing-777-200erSurinam Airways kiest voor de Boeing 777-200ER als vervanger voor de huidige Airbus A340-300 voor het uitvoeren van vluchten tussen Paramaribo en Schiphol. Volgens Surinaamse media is daarvoor een leaseovereenkomst gesloten met Boeing.

De Surinaamse luchtvaartmaatschappij (SLM) vloog tot nu toe altijd met viermotorige toestellen op de enige verre route. Zo werden de Douglas DC-8, Boeing 747-300 en Airbus A340-300 ingezet. Laatstgenoemde type wordt op dit moment ingezet, maar is hard aan vervanging toe.

Surinam Airways maakte er de afgelopen jaren geen geheim van te willen overschakelen op zuinigere tweemotorige types. Om daarmee vluchten over de Atlantische Oceaan uit te voeren is echter een ETOPS-certificering nodig, die het bedrijf tot nu toe niet had. Daar zou op korte termijn verandering in moeten komen.

De huur van de Boeing 777-200ER, die in een vorig leven voor Singapore Airlines en Air New Zealand vloog, zou van tijdelijke aard zijn. Een moderne Boeing 787 Dreamliner zou de taken van de Triple Seven op den duur moeten overnemen.

Specifiek gaat het om de voormalige 9V-SVL van Singapore Airlines. First flight op 14 november 2002, en op 10 juni 2018 als ZK-OKI geleased aan Air New Zealand.

Virussen? Scan ze hier!

Dat is echt ontzettend goed nieuws voor ze, eindelijk een ETOPS-certificaat en eindelijk met efficiënte toestellen kunnen vliegen.wildhagen schreef op zaterdag 22 juni 2019 @ 11:16:

[...]

Surinam Airways kiest nu toch voor de Boeing 777-200ER als opvolger van hun A340. Weliswaar tijdelijk, want uiteindelijk willen ze dus een 787 gaan aanschaffen.

[...]

Zie https://www.luchtvaartnie...est-voor-boeing-777-200er

Specifiek gaat het om de voormalige 9V-SVL van Singapore Airlines. First flight op 14 november 2002, en op 10 juni 2018 als ZK-OKI geleased aan Air New Zealand.

[Afbeelding]

Ben benieuwd of de bewuste 777-212ER een variant is met geknepen motoren, aangezien Singapore Airlines meer dan de helft van hun 777-200ER's met gereduceerd vermogen heeft laten leveren.

Volgens mij werden die derated modellen door SQ als -200's geclassificeerd, en niet als -200ER's, zoals dit toestel.gop1 schreef op zaterdag 22 juni 2019 @ 20:49:

[...]

Ben benieuwd of de bewuste 777-212ER een variant is met geknepen motoren, aangezien Singapore Airlines meer dan de helft van hun 777-200ER's met gereduceerd vermogen heeft laten leveren.

Van Wikipedia: Singapore Airlines fleetWhile Singapore Airlines lists some of its 777-200ER jets as 777-200 aircraft, all of the supposed -200 series aircraft were all built with enhancements usually exclusive to the -200ER, with the single modification being the Trent 892 engines derated to the -884 spec used on the standard -200 aircraft, reducing the MTOW and thus aircraft fees at the airport when categorized by maximum takeoff weight (MTOW).[

De 8 -200's en 5 -200ER's die SQ nu nog heeft gaan er overigens allemaal uit, en worden vervangen door de A350-900 en 787-10. Net als hun 5 -300's. Ze houden dus uiteindelijk alleen hun 27-300ER's nog over.

[ Voor 4% gewijzigd door wildhagen op 22-06-2019 21:17 ]

Virussen? Scan ze hier!

De luchtvaartwereld is een bekende 747 operator kwijt; de Japan Air Self-Defense Force (JASDF), ook wel bekend als de Japanese Air Force One. (en Two)

Vorig jaar waren de vervangende 777-300ER toestellen al geleverd maar nu hebben die twee 777's de taken van de 747's definitief overgenomen. De 747's werden eind 1991 geleverd.

Bijzonder is dat een van de twee 747's (20-1102) afgelopen dinsdag-woensdag is overgevlogen van

Chitose Air Base via Anchorage naar Pinal Airpark, Arizona maar later zal doorvliegen naar Tel Aviv om daar omgebouwd te worden tot vrachtvliegtuig.

Het andere toestel is overgenomen door hetzelfde bedrijf dus grote kans dat die ook omgebouwd zal worden.

Bijzonder om een dergelijk regeringstoestel een tweede leven elders te zien krijgen (en niet in een museum o.i.d.) en dat de 747 omgebouwd wordt tot vrachttoestel.

De laatste 747 pax-cargo verbouwing vond ook plaats in Tel Aviv door Bedek en waren 2 Asiana Airlines 747's die eind 2017 als vrachttoestel terugkeerden naar Asiana.

Want zo'n privaat vliegtuig heeft belange nog niet de vlieguren gedaan die een pax vliegtuig zou afleggen in zo'n tijdspanne.

Is dus nog een jong veulen eigelijk dat nu aan zijn zwaarder leven gaat beginnen

[ Voor 4% gewijzigd door bottom line op 23-06-2019 00:29 ]

Dat is waar, maar het is best bijzonder dat er nu mogelijk 2 747's tot freighters worden omgebouwd; dat gebeurd niet of nauwelijks meer.bottom line schreef op zondag 23 juni 2019 @ 00:28:

Logisch op zich.

Want zo'n privaat vliegtuig heeft belange nog niet de vlieguren gedaan die een pax vliegtuig zou afleggen in zo'n tijdspanne.

Is dus nog een jong veulen eigelijk dat nu aan zijn zwaarder leven gaat beginnen

En ook best bijzonder dat een dergelijk regeringstoestel ergens als vrachttoestel gaat vliegen i.p.v. museum/sloop o.i.d.; persoonlijk vind ik dat ook wel bijzonder.

Nou niet echt.Piet91 schreef op zondag 23 juni 2019 @ 16:19:

[...]

Dat is waar, maar het is best bijzonder dat er nu mogelijk 2 747's tot freighters worden omgebouwd; dat gebeurd niet of nauwelijks meer.

En ook best bijzonder dat een dergelijk regeringstoestel ergens als vrachttoestel gaat vliegen i.p.v. museum/sloop o.i.d.; persoonlijk vind ik dat ook wel bijzonder.

Enkel 747's hebben een CF programma. De concurrent van de 747F, de 777F moet van oorsprong zo zijn. Die kan je niet ombouwen van pax naar F. Zo'n 2dehands 777 vliegtuigen zijn er ook amper. En nieuw kosten ze veel, maar dan ook echt, enorm veel te veel ivm met een 747F.

Dus nu kunnen ze beide omgebouwd worden en nog een 20 jaar lease opbrengen. Qua comfort voor piloten alsook qua volume van vracht wint de 747 sowieso. Qua brandstof kosten daarentegen.. maar dat maakt de leaseprijs echt wel goed (ook al moeten ze de vliegtuigen nog ombouwen).

Ze kunnen hem later nog wel slopen, al zullen er dan wel amper parts nodig zijn vermoed ik

De integratie met Eurowings was al min of meer gestart: een nieuwe A320 voor SN zou in Eurowings livery gespoten worden.De integratie van luchtvaartmaatschappij Brussels Airlines in Eurowings wordt stopgezet. Dat heeft de Lufthansa-groep aangekondigd. Bijkomende besparingen zijn ten vroegste voor het derde kwartaal.

Brussels Airlines wordt dan toch niet opgeslorpt in de lagekostenpoot van de Duitse moeder Lufthansa. De integratie in Lufthansa-dochter Eurowings wordt stopgezet. In plaats daarvan zal Brussels Airlines - dat vooral in Afrika een sterke marktpositie heeft - nauwer gaan aansluiten bij de andere 'premium'-maatschappijen van de Lufthansa-groep, gebundeld in Network Airlines, zoals Lufthansa zelf, Austrian Airlines en Swiss. Eurowings zal zich voortaan louter concentreren op korte vluchten binnen Europa.

Voor gehele artikel bron aanklikken.In het noorden van Duitsland zijn twee gevechtsvliegtuigen van de Duitse luchtmacht neergestort. Volgens de eerste berichten hebben de twee piloten zichzelf met hun schietstoel in veiligheid kunnen brengen. Een van de piloten zou terecht zijn, de ander is nog zoek.

[...]

Edit: helaas is er toch een dode te betreuren.

[ Voor 11% gewijzigd door Cheesy op 24-06-2019 18:16 ]

Integratie van Brussels Airlines met Eurowings is dus van de baan, maar SN moet wel beter gaan presteren en er komt binnenkort een "turnaround plan".Lufthansa Group heeft een grote reorganisatie aangekondigd van de activiteiten van Eurowings. Dat leidt onder meer tot het staken van de integratie van Brussels Airlines met de budgetmaatschappij van de luchtvaartgroep. Ook stopt Eurowings met longhaul-vluchten.

De verandering van koers betekent ook dat de de ophanden zijnde integratie van Brussels Airlines met Eurowings van de baan is. In plaats daarvan gaat Lufthansa Group de banden van de Belgische luchtvaartmaatschappij met de netwerkcarriers Lufthansa, SWISS en Austrian Airlines verstevigen. In het derde kwartaal van dit jaar komt Lufthansa Group met een ‘turnaround plan’ voor Brussels Airlines.

En Eurowings stop dus met lange afstandsvluchten. Lufthansa is erachter gekomen dat low cost long haul niet rendabel is...

bronAirbus SE vowed to put up a fight to undo a $24 billion deal landed by rival Boeing Co. for 737 Max planes that proved to be the sales coup of this year’s Paris Air Show.

Speaking at a final press conference from Le Bourget airfield outside the French capital on Thursday, Airbus sales chief Christian Scherer said the European planemaker never received a request for proposals—a document that formally launches bidding for most major aircraft contracts—from IAG SA, the owner of British Airways.

Als dat klopt (potentiele order van 24 miljard zonder RFP) kan ik me voorstellen dat dit nog wel een staartje krijgt.

Root don't mean a thing, if you ain't got that ping...

Waarom? IAG is geen overheid, ze hebben geen verplichting om bij Airbus aan te vragen.ijdod schreef op dinsdag 25 juni 2019 @ 08:19:

Airbus is uiteraard not amused over die letter of intent van IAG.

[...]

bron

Als dat klopt (potentiele order van 24 miljard zonder RFP) kan ik me voorstellen dat dit nog wel een staartje krijgt.

Denk dat Boeing ze zelf benaderd heeft met een offer-they-couldn't-refuse. Dit om de verwachte clean-sweep van Airbus op de airshow te verhinderen. Voorwaarde van Boeing was dan waarschijnlijk dat ze er tot het moment van aankondiging niks over mochten zeggen.

Had gehoopt dat ze de KLM hiermee benaderd hadden

If buying doesn’t mean ownership Then pirating isn’t stealing / iRacing Profiel

Root don't mean a thing, if you ain't got that ping...

Aandeelhouders kunnen hier nog wel een woordje voor over hebben. Als Airbus nu bijvoorbeeld met een beter voorstel komt en IAG heeft vanaf het begin niet naar Airbus gekeken zou je kunnen zeggen dat ze niet in het beste belang van de aandeelhouders hebben gewerkt. Maar dat hangt ook weer af van hoe ze de aandeelhouders hebben ingelicht etc.alexbl69 schreef op dinsdag 25 juni 2019 @ 09:38:

[...]

Waarom? IAG is geen overheid, ze hebben geen verplichting om bij Airbus aan te vragen.

Denk dat Boeing ze zelf benaderd heeft met een offer-they-couldn't-refuse. Dit om de verwachte clean-sweep van Airbus op de airshow te verhinderen. Voorwaarde van Boeing was dan waarschijnlijk dat ze er tot het moment van aankondiging niks over mochten zeggen.

Had gehoopt dat ze de KLM hiermee benaderd hadden.

Mij boeit het verder niet, ik vlieg niet met de IAG airlines dus Boeing of Airbus daar zal mij een worst zijn

[ Voor 4% gewijzigd door Propane op 25-06-2019 13:07 ]

Ik was niet de enige die denkt dat er een stevige korting is bedongen. Het wordt geschat minimaal in het 65% 'ballpark' te liggen. Ze hebben ze nog net niet cadeau gegeven.

Boeing's tentative deal to sell up to 200 737 Max jets to Europe's International Air Group came with steep discounts — 60 percent or more off the estimated $24 billion list price, aerospace analysts said.

The Chicago-based jet maker surprised the aerospace world at the Paris Air Show last week with the commitment from IAG, owner of British Airways, Ireland's Aer Lingus and Iberia of Spain. The deal was unexpected because IAG airlines operate mostly Airbus single-aisle jets.

Though airlines and jet makers rarely discuss them, big airlines often secure discounts of up to 50 percent of the list price on orders from companies like Boeing and its French-German rival Airbus.

"We suspect the order was done at a deep discount to list price, but likely validates the aircraft over the long-term," Cowen and Company airline analyst Helane Becker told clients.

IAG Chief Financial Officer Enrique Dupuy de Lôme revealed in a securities filing that IAG "negotiated a substantial discount from the list price" in the Boeing deal.

Boeing and IAG haven't detailed the actual number of each aircraft model included in their agreement, but IAG committed to buy a mix of 737 Max 8s and 737 Max 10s. If the sale is finalized, the 737 Maxs, assembled in Renton, will be delivered between 2023 and 2027.

Aerospace analyst Dhierin Bechai said in a report that to secure a potential megaorder, the typical discount rises from 50 percent to roughly 60 percent, bringing the actual sales price closer to between $9.7 billion and $10.7 billion, depending on the mix of 737 Maxs ordered.

"On top of that, the airline group could have negotiatedup to 5-6 percent (an additional price cut on top of 60 percent discount) since it is a key customer of Airbus for it single-aisle jets," Bechai wrote.

Bainbridge Island analyst Scott Hamilton wrote on his Leeham aerospace analysis web site that discounts of 50 to 60 percent off list prices are "common knowledge.

"Leeham is aware of some deals in which discounts run as high as 65 (percent)," he wrote. "You can bet IAG is at least in this ballpark."

Boeing did not respond to a request for comment. Its 737 Max 8 lists for $121.6 million. The 737 Max 10, still under development, has a $134.9 million sticker price.

Steep discounts were likely necessary, given sales challenges for the 737 Max because the plane has been grounded globally since March after two crashes killed 346 people, said Seattle-based analyst Michel Merluzeau.

"It's still a tentative deal but is good news for the Max and Boeing can now start to see the light at end of the long tunnel," Merluzeau said.

Airbus cried foul.

“We would like a chance to compete for that business,” Airbus Chief Commercial Officer Christian Scherer told reporters at the air show, Reuters reports.

Schere said IAG never issued a formal call for bids before unveiling its deal with Boeing.

Je zou dom zijn als je daar nee tegen had gezegd.CaptJackSparrow schreef op dinsdag 25 juni 2019 @ 15:37:

Boeing gave IAG 'substantial discount' in 737 Max megadeal

Ik was niet de enige die denkt dat er een stevige korting is bedongen. Het wordt geschat minimaal in het 65% 'ballpark' te liggen. Ze hebben ze nog net niet cadeau gegeven.

[...]

Moeten toch wat met al die 737 Max toestellen die niemand wil.

Bombardier verkoopt het CRJ-programma voor 550 miljoen Amerikaanse dollar aan de Mitsubishi Aircraft Corporation. Daardoor stopt het Canadese bedrijf helemaal met de commerciële vliegtuigen-divisie.

Als onderdeel van de overeenkomst verkrijgt Mitsubishi onder meer de onderhouds-, support-, marketing en sales-activiteiten van het CRJ-programma. De expertise en faciliteiten die dat oplevert willen de Japanners gebruiken voor een succesvolle uitrol van hun eigen SpaceJet.

De Bombardier-fabriek in Mirabel wordt niet overgenomen. Bombardier zal daar namens Mitsubishi de laatste CRJ’s produceren die nog in het orderboek staan. De productie van deze toestellen wordt in de tweede helft van 2020 gestaakt.

En waar niemand in wil stappen bedoel jeDeadsy schreef op dinsdag 25 juni 2019 @ 16:15:

[...]

Je zou dom zijn als je daar nee tegen had gezegd.

Moeten toch wat met al die 737 Max toestellen die niemand wil.

Got Leenucks? | Debian Bookworm x86_64 / ARM | OpenWrt: Empower your router | Blogje

Jij niet en ik ook niet, maar genoeg andere mensen kijken geeneens naar wat voor toestel ze zitten.

En stel dat ze aan het begin wat korting geven op de tickets.

[ Voor 9% gewijzigd door Tourniquet op 25-06-2019 22:25 ]

If our brain was easy to understand, we would be too dumb to understand.

Het is de eerste van 25.

Zoals verwacht gaat deze ook ingezet worden naar Amsterdam; te beginnen op 26 juli op zowel een ochtend- als avondvlucht; eerste aankomst op Schiphol is om 09:50 en vertrekt weer om 11:20 uur.

's Avonds komt de 787 om 21:45 uur aan en vertrekt weer om 23:15 uur.

Turkish Airlines Boeing 787-9 TC-LLA by Royal King, on Flickr

Turkish Airlines Boeing 787-9 TC-LLA by Royal King, on Flickr

If our brain was easy to understand, we would be too dumb to understand.

Vlucht 1405 vanuit Rome: https://www.flightradar24.com/AFR55VY/210cc4ec

Vlucht 1583 vanuit Praag: https://www.flightradar24.com/AFR67RD/210cd559

Beiden worden om 22:20 uur verwacht op Parijs-Charles de Gaulle.

Morgen worden de vluchten weer overgenomen door Air France; net geen 19 maanden na de eerste Joon vluchten op 1 december 2017.

De A320/A321's worden uiteindelijk weer overgespoten in Air France livery; de A340-300's zullen hun carrière uitzitten in de Joon livery.

https://www.luchtvaartnie...0-in-op-europese-vluchten

Vooral de vlucht naar Lissabon is interessant, want die wordt uitgevoerd door de mooie lange 600- versie.

Ik heb een retourtje geboekt: in business class

Zeker.alexbl69 schreef op dinsdag 25 juni 2019 @ 09:38:

[...]

Waarom? IAG is geen overheid, ze hebben geen verplichting om bij Airbus aan te vragen.

Maar doorgaans wordt een request for proposal (RFP) uitgezonden, en de aanbieder met de beste deal wordt dan gekozen. Zo'n deal omvat niet alleen de aankoop van vliegtuigen zelf, maar bevat ook training, onderhoud, spare parts, eventueel financiering, soms terugnemen van oude vliegtuigen, etc.

Het is gewoon opvallend dat IAG zomaar een letter of intent (is nog geen bestelling dus) bij Boeing neerlegt. Deze manier van zaken doen zien je niet vaak in de luchtvaartsector, behalve als het om trouwe klanten gaat (denk aan Southwest Airlines).

Die extra baan is al een tijdje bekend toch? Maar ze gaan behoorlijk wat verbouwen, 2026 is dan wel een hele optimische streefdatumTourniquet schreef op woensdag 26 juni 2019 @ 21:05:

Hebben jullie dit gezien? Vrij ambitieus plan om een extra baan aan te leggen ten noorden van Heathrow.

[YouTube: Heathrow Expansion - The Preferred Masterplan]

[ Voor 24% gewijzigd door Sand0rf op 27-06-2019 08:27 ]

/post

Eigenlijk is het niet helemaal onlogisch. Een LOI is zoals je terecht aangeeft niet bindend, maar heeft wel degelijk consequenties. In die zin dat er een prijs bepaald is (die naar verluid extreem gunstig is), plus dat Airbus extra door de knieën zal moeten voor het weer ongedaan maken van de LOI met Boeing.XWB schreef op donderdag 27 juni 2019 @ 00:36:

[...]

Zeker.

Maar doorgaans wordt een request for proposal (RFP) uitgezonden, en de aanbieder met de beste deal wordt dan gekozen. Zo'n deal omvat niet alleen de aankoop van vliegtuigen zelf, maar bevat ook training, onderhoud, spare parts, eventueel financiering, soms terugnemen van oude vliegtuigen, etc.

Het is gewoon opvallend dat IAG zomaar een letter of intent (is nog geen bestelling dus) bij Boeing neerlegt. Deze manier van zaken doen zien je niet vaak in de luchtvaartsector, behalve als het om trouwe klanten gaat (denk aan Southwest Airlines).

IAG heeft nu bijna exclusief Airbus toestellen voor de middellange afstand, maar heeft al aangegeven minder afhankelijk te willen zijn van één fabrikant.

Al met al zal Airbus extreem diep door de knieën moeten om dit alsnog om te draaien. En dat kan natuurlijk ook het doel zijn van IAG.

If buying doesn’t mean ownership Then pirating isn’t stealing / iRacing Profiel

Ja je hebt gelijk, maar ik had even gemist dat er nu een concreet masterplan ligt. 2026 voor het openen van de baan lijkt me behoorlijk optimistisch inderdaad. Al lopen de totale bouwplannen door tot 2050.Sand0rf schreef op donderdag 27 juni 2019 @ 08:21:

[...]

Die extra baan is al een tijdje bekend toch? Maar ze gaan behoorlijk wat verbouwen, 2026 is dan wel een hele optimische streefdatum

Meer info staat op: https://www.bbc.com/news/business-48668001

Er moeten dus ook 761 huizen voor verdwijnen.

If our brain was easy to understand, we would be too dumb to understand.

Het is geen wedstrijd wie de meeste vliegtuigen verkoopt. Er moet gewoon geld verdiend worden en je kunt beter een order mislopen dan voor een bodemprijs verkopen. Het is niet alsof Airbus op omvallen staat en geen order kan missen.alexbl69 schreef op donderdag 27 juni 2019 @ 09:11:

[...]

Al met al zal Airbus extreem diep door de knieën moeten om dit alsnog om te draaien. En dat kan natuurlijk ook het doel zijn van IAG.

Gek op alles wat met vliegen te maken heeft, daar staat Atilay Uslu, oprichter van

Corendon Hotels & Resorts, om bekend. Een stoere jongensdroom kwam voor hem uit

toen de immens grote Boeing 747 in de achtertuin van het grootste hotel van de

Benelux werd geplaatst (Corendon Village Hotel). Corendon Mission 747 was een zeer

uniek en spannend project dat nog nergens ter wereld had plaatsgevonden. In deze

periode is alles tot op de voet gevolgd door een cameraploeg waar elk belangrijk

moment is meegenomen. De aankoop van het vliegtuig, het overspuiten van de KLM

kleuren naar de welbekende Corendon verschijning, tot het meest spectaculaire

moment; de oversteek van A9. Ben jij benieuwd hoe deze droom werkelijkheid is

geworden? Bekijk de documentaire Corendon Mission 747 en vlieg mee in dit

onwerkelijke verhaal.

Wil jij dit avontuur op groot scherm zien in onze Corendon Cinema? Koop dan je kaartjes online (slechts €5,- inclusief bak popcorn) voor de première op maandag 8 juli.

Wel, de overname is nu bevestigd:

Air Canada neemt vakantievlieger Air Transat definitief over. Met de deal is 520 miljoen dollar gemoeid. Beide partijen waren al sinds het najaar van 2018 in gesprek, maar sinds mei raakten de onderhandelingen in een stroomversnelling.

Door de overname, die donderdag werd goedgekeurd door de aandeelhouders, krijgt Air Canada er een flink aantal vliegtuigen en bestemmingen bij en kan het haar aandeel op de vakantiemarkt flink uitbreiden.

1 keer met Air Transat gevlogen in een stokoude A310 van AMS naar YYZ. Wat een oncomfortabele reis was dat zeg....

Kia Niro-EV 2024

En wat betaalde je er voor?Freak187 schreef op vrijdag 28 juni 2019 @ 10:15:

[...]

1 keer met Air Transat gevlogen in een stokoude A310 van AMS naar YYZ. Wat een oncomfortabele reis was dat zeg....

* mystic ook. Maar vond het eigenlijk wel super vermakelijk. CRT schermen die naar beneden komen met daarom Mrs Doubtfire op VHS.Freak187 schreef op vrijdag 28 juni 2019 @ 10:15:

[...]

1 keer met Air Transat gevlogen in een stokoude A310 van AMS naar YYZ. Wat een oncomfortabele reis was dat zeg....

Verder was het een versleten interieur maar viel het me echt alleszins mee.

De terugvlucht was in een toestel van ze dat net compleet was vernieuwd van binnen. En dat was, voor de prijs, echt helemaal prima.

One day I will solve my problems with maturity. Today however, it will be Margaritas

Verwijderd

https://luchtvaartnieuws....ing-787-10-klm-afgeblazen

Geen idee, was een dienstreis. Maar het was zelfs voor die tijd (2010 geloof ik), een ouderwetsche bak.

Kia Niro-EV 2024

De video is ook zeker het bekijken waard: https://www.facebook.com/...643?s=3623328&v=e&sfns=cl

Air France neemt de A350's en de Dreamliners gaan naar KLM.

Ik bespeur hier een zekere mate van onethische logica.

Verwijderd

Staat nu voor zondag 08:30lt op de planning.Verwijderd schreef op vrijdag 28 juni 2019 @ 12:08:

Helaas komt morgen de KLM 787-10 niet naar Schiphol:

https://luchtvaartnieuws....ing-787-10-klm-afgeblazen

Update:

Na de landing zal er een 5 minuten stop gemaakt worden bij de McDonalds aan de Loevesteinserandweg (27/09).

https://www.luchtvaartnie...zondagochtend-op-schiphol

[ Voor 31% gewijzigd door Verwijderd op 29-06-2019 16:44 ]

Er lijkt toch echt wat aan de hand te zijn bij Boeing South Carolina:Brilsmurfffje schreef op maandag 22 april 2019 @ 00:56:

[...]

Iemand bij de New York times heeft op YouTube naar de docu over de Dreamliner van Aljazira gekeken. Bizar hoe ze dat overgeschreven hebben zonder die bron te vermelden. Alles voor de clicks..

Federal prosecutors have subpoenaed records from Boeing relating to the production of the 787 Dreamliner in South Carolina, where there have been allegations of shoddy work, according to two sources familiar with the investigation.

The subpoena was issued by the Department of Justice (DOJ), the sources said. DOJ is also conducting a criminal investigation into the certification and design of the 737 MAX after two deadly crashes of that jetliner.

The 787 subpoena significantly widens the scope of the DOJ’s scrutiny of safety issues at Boeing.

Toen die zo voorbij rolde zat ik ook al te kijken van huh? Had fraaier geweest als ze die cijfers een enkele kleur hadden gegeven en dat KLM eruit, of ze hadden hem wat kleiner moeten maken en dan had je dat probleem niet gehad.

Ik krijg bij deze foto toch een beetje het gevoel dat die DC-3 niet mee mocht doen aan het feestje en nu om de hoek staat toe te kijken

Onder 4 meter ijs en sneeuw:

“The search phase involved more than 13 weeks in Greenland, with seven weeks camping on the ice sheet, working in a crevasse field by foot, snowmobile, and robot, night-time operations, risk of polar bears, temperatures down to -35°C, and wind storms up to 25 m/s, with gusts up to 32 m/s,” explains field team leader Ken Mankoff, Senior Researcher at GEUS.

https://eng.geus.dk/about...-by-geus-led-expeditions/“For this year’s search we invited Polar Research Equipment and their FrostyBoy robot to help us work safely in the crevasse field. We also invited the Aarhus University HydroGeophysics Group to join us with their Transient ElectroMagnetic instrument (TEM) which is normally used for mapping groundwater. Aarhus built a custom version, SnowTEM, that we could tow by snowmobile over the ice. Both FrostyBoy and the SnowTEM detected the part,” says Kenneth Mankoff.

The missing piece, a ~150 kg piece of titanium about 1 m3 was found buried under ~4 m of snow and ice on the Greenland Ice Sheet and in the middle of a crevasse field. Crevasses were located less than 2 m from the part and some in the surrounding field were 30 m wide.

O..a met behulp van FrostyBoy:

En vandaag vond de eerste vlucht plaats.XWB schreef op donderdag 6 juni 2019 @ 21:41:

En daar is de eerste BA A350-1000 in volledig kleurenschema:

[Afbeelding]

F-WZFH Airbus A350-1000 British Airways by @Eurospot, on Flickr

F-WZFH AIRBUS A350-1000 British Airways by @Eurospot, on Flickr

![]() Dit topic is gesloten.

Dit topic is gesloten.

![]()

Let op: Voor vragen over reizen, tickets, frequent flyer programma's, kan je hier terecht:

Reizen met het Vliegtuig - Deel 1

Discussies over de crashes met de 737 Max niet hier, maar in topic Ontwikkelingen omtrent de Boeing 737 Max

Discussie over staatssteun aan luchtvaartmaatschappijen, die passen in KLM AF en andere luchtvaartmijs in tijden van corona-steun?

:strip_exif()/u/134183/Barbabeau-5.gif?f=community)

/u/46804/crop5f989efcbb253.png?f=community)

:strip_icc():strip_exif()/u/379256/crop58e160bbc5c02_cropped.jpeg?f=community)

:strip_icc():strip_exif()/u/157485/ava.jpg?f=community)

:strip_icc():strip_exif()/u/176887/crop632c25995af8b.jpg?f=community)

:strip_icc():strip_exif()/u/8440/FlyGuy.jpg?f=community)

:strip_icc():strip_exif()/u/12949/feyenoord.jpg?f=community)

:strip_icc():strip_exif()/u/326874/crop588097c82e375_cropped.jpeg?f=community)

/u/22388/header-logo.png?f=community)

/u/53007/DustPuppy.png?f=community)

:strip_icc():strip_exif()/u/626559/crop59916d9743d5c_cropped.jpeg?f=community)

:strip_icc():strip_exif()/u/25212/crop5bb715b4827b7_cropped.jpeg?f=community)

:strip_exif()/u/3157/sail4L_S70.gif?f=community)

:strip_icc():strip_exif()/u/291935/crop58e292b81413e.jpeg?f=community)

:strip_icc():strip_exif()/u/14/wildhagen60x60.jpg?f=community)

/u/62599/crop5db5f4e240e45.png?f=community)

:strip_icc():strip_exif()/u/84176/crop577a4401d15ce_cropped.jpeg?f=community)

:strip_icc():strip_exif()/u/235616/crop5bfeeab0f02dc_cropped.jpeg?f=community)

:strip_icc():strip_exif()/u/566249/zwart_schaap.jpg?f=community)

/u/272550/crop5efcf53f199c9.png?f=community)

:strip_icc():strip_exif()/u/75828/sid.jpg?f=community)

:strip_icc():strip_exif()/u/9591/space.jpg?f=community)

:strip_icc():strip_exif()/u/775951/crop5e7e7365951d5_cropped.jpeg?f=community)

/u/1906/crop5dfd46928e003.png?f=community)

:strip_icc():strip_exif()/u/63487/penta2.jpg?f=community)

:strip_icc():strip_exif()/u/468215/2878fb0a719044e712930cabcdd50fdb.jpeg?f=community)