Het verbaasd mij altijd dat Ziggo er in mee gaat voor de klanten die jaarlijks bellen. Je zou toch denken dat je na 1 of 2 keer wel een 'vinkje' achter je naam krijgt.

Maar goed (Vodafone)Ziggo heeft het lastig dus wellicht moeten ze daar wel in mee gaan, nieuwe klanten werven is ook niet gratis. Voor wie het niet weet; het resultaat voor Ziggo in 2018 was een verlies van 77,5 miljoen, in 2017 229 miljoen. Operationele winst overigens respectievelijk 110 en 193 miljoen.

https://www.vodafoneziggo...rverslagen-vodafoneziggo/

Hoe meer mensen bellen des te hoger de verhoging volgend jaar

.

edit: Voor wie het interessant vindt

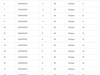

3.895 omzet

-858 programming and other direct cost

-467 other operating

-643 SG&A*

-227 Joint Venture

-1552 Depreciation and amortization expense **

-35.7 impariment

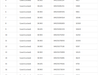

*SG&A expenses

General. SG&A expenses include human resources, information technology, general services, management, finance, legal, external sales and marketing costs, share-based compensation, and other general expenses.

II-10

Our SG&A expenses decreased by €45.9 million or 6.7% during 2018, as compared to 2017. Our SG&A expenses include share-based compensation expense, which decreased €2.5 million. Excluding the effects of share-based compensation expense, our SG&A expenses decreased by €43.4 million or 6.3%. This decrease includes the following factors:

• A decrease in sales and marketing costs of €29.8 million or 12.3%, primarily driven by lower sales commissions and lower rebranding campaign expenses in 2018 as compared to 2017;

• A decrease in other costs of €8.5 million or 21.6%, primarily due to lower property costs and lower consumer credit costs;

• A decrease in personnel costs of €5.9 million or 2.2%, primarily due to a decrease in staffing levels as a result of restructuring relating to certain reorganization and integration activities, partially offset by a decrease in capitalization of labor cost in 2018;

• An increase in network and IT costs of €2.9 million or 9.0%, primarily due to a decrease in capitalized IT costs in 2018; and

• An increase in business services costs of €1.0 million or 1.3%, primarily due to an increase in consultancy and legal costs, partially offset by decrease in fleet costs and facility management costs.

**Depreciation and amortization expense

Our depreciation and amortization expenses increased by €65.9 million or 4.4% during 2018, respectively, as compared to 2017. This increase is primarily due to property and equipment additions related to the expansion and upgrade of our network and accelerated depreciation associated with the closure of office locations as a part of our integration efforts.

[

Voor 69% gewijzigd door

sdk1985 op 22-05-2019 14:29

]

:fill(white):strip_exif()/i/2001533281.jpeg?f=thumbmini)

:strip_exif()/i/2002716354.png?f=thumbmini)

:strip_exif()/i/2005110790.png?f=thumbmini)

:strip_exif()/i/2001533283.png?f=thumbmini)

:strip_icc():strip_exif()/u/371543/pirat60.jpg?f=community)

:strip_exif()/u/32724/00050.gif?f=community)

/u/109292/crop673c567047cc4_cropped.png?f=community)

:strip_exif()/u/525317/crop60aca2eed8393_cropped.gif?f=community)

:strip_icc():strip_exif()/u/1060267/crop5ac724e66d607_cropped.jpeg?f=community)

:strip_exif()/u/128173/crop59a1592e54731_cropped.gif?f=community)

:strip_icc():strip_exif()/u/52072/crop5de51ebf91960_cropped.jpeg?f=community)

:strip_exif()/u/68527/stingchameleonani.gif?f=community)

:strip_icc():strip_exif()/u/212073/crop5790930e15fe8_cropped.jpeg?f=community)

/u/46215/crop5ac0b142c11e7_cropped.png?f=community)

:strip_exif()/u/202473/crop58510f048ef8f_cropped.gif?f=community)

/u/375324/crop5d95a2d427d1d_cropped.png?f=community)

:strip_icc():strip_exif()/u/241948/crop58dd1b1aa2aef.jpeg?f=community)

:strip_exif()/u/27688/level42princess1.gif?f=community)

/u/103745/crop68d2609ea7f50_cropped.png?f=community)

:strip_icc():strip_exif()/u/151835/crop56a4fdd103ba5_cropped.jpeg?f=community)

:strip_icc():strip_exif()/u/353511/crop5f364a4fd2fa5_cropped.jpeg?f=community)

:strip_icc():strip_exif()/u/131116/crop583a94b7c4c15_cropped.jpeg?f=community)

:strip_icc():strip_exif()/u/122280/crop5f33e05ceebdd_cropped.jpeg?f=community)

/u/96951/crop5db75377e35bf_cropped.png?f=community)

:strip_icc():strip_exif()/u/65843/chef60x60.jpg?f=community)

:strip_icc():strip_exif()/u/48963/dewi.jpg?f=community)