516K subscribers 👍🏻 5.2K 👎🏻 428 🔕 Notify ➦ Share ▤ᐩ Save

Je misrekent jezelf met extra rendement bij 50/50...je hebt 50% van de lasten maar ook de inkomsten dus rendement is gelijk aan volledig eigenaar zonder hefboomVerwijderd schreef op zaterdag 23 november 2019 @ 19:15:

Beste FO'ers en FO'ers in wording,

Al gedurende enkele jaren lees ik mee op dit topic maar wegens tijdgebrek nooit actief deelgenomen. Nu wij eindelijk meer tijd hebben kunnen we eens goed naar onze FO ambities gaan kijken.

***members only***

Optie 1 pak je een hefboom waardoor je rendement op ingelegd vermogen verhoogd (bijvoorbeeld bij weer 50/50 financiering heb je dan wel 100% van de opbrengsten)

Verwijderd

Dank voor je reactie en tip. Ben recent begonnen op flatex, geen grote bedragen nog en niks structureels. Vanaf volgend jaar wel de bedoeling hier meer structureel mee bezig te zijn.TucanoItaly schreef op zaterdag 23 november 2019 @ 19:40:

@Verwijderd Ik zou sowieso eens beginnen met beleggen. Dan zie je wat dat "doet" met je. Wellicht vind je het veel te ingewikkeld, vind je eega het te spannend, enz. Dat elimineert keuzes.

Wow inderdaad, nooit zo gezien maar snap direct wat je bedoeld. Dankje!jsuijker schreef op zaterdag 23 november 2019 @ 19:58:

[...]

Je misrekent jezelf met extra rendement bij 50/50...je hebt 50% van de lasten maar ook de inkomsten dus rendement is gelijk aan volledig eigenaar zonder hefboom

Optie 1 pak je een hefboom waardoor je rendement op ingelegd vermogen verhoogd (bijvoorbeeld bij weer 50/50 financiering heb je dan wel 100% van de opbrengsten)

Ben je nu FO, of niet?kabelmannetje schreef op zaterdag 23 november 2019 @ 15:07:

[...]

Dat is helaas makkelijker gezegd dan gedaan. Ben inmiddels een jaar of 6 FO en soms ben ik een tijdje in NL en denk...ik ga eens wat (simpel maar leuk) werk doen.

Maar, dat valt enorm tegen.

Ten eerste ben je heel snel overgekwalificeerd door je eerdere carrière en is deze ervaring niet zo relevant. Of het schrikt de werkgever juist af (mondig, want overgekwalificeerd) en krijg je de raarste afwijzingen.

Ten tweede, omdat je niet hoeft te werken, heb je al snel enorme gaten in je CV. Ik moet alles bij elkaar liegen om überhaupt op gesprek te komen. Dan heb ik het niet eens over het gesprek zelf. Lange periodes van reizen, gewoon paar maanden niksen, het is alsof je van een andere planeet komt. Mensen hebben echt geen idee dat je FO kan zijn en behandelen je alsof je in de bijstand zit.

Ten derde, de sector waarin ik zat (ICT) is dusdanig conservatief dat je al snel als 'lastig' wordt gezien. Daar worden alleen full time contracten verdeeld en zitten ze niet te wachten op iemand die 2-3 dagen werkt en waar ze niet het gevoel bij hebben dat je jaren afhankelijk bent van de hand die je voedt. Stop er een paar wereldreizen of lange breaks in en je kan het helemaal wel vergeten.

Het bizarre is dat als je hetzelfde werk als vrijwilliger doet, je meteen welkom bent. Daarom eerst FO en daarna iets leuks als vrijwilliger zoeken.

Dat bedrijven je als lastig ervaren is wel te verklaren als je erbij bedenkt dat het je doel is (als ik me niet vergis) om zo snel mogelijk wat WW op te bouwen en dan weer op kosten van de samenleving ergens heen te vertrekken.

Als de gaten in je CV een patroon hebben is dat snel doorzichtig

Als je iets meer wil doen dan vakkenvuller bij AH, dan zoekt een werkgever iemand die zich verbindt, of tenminste waar de kans wat groter is voor een langere termijn.kabelmannetje schreef op zaterdag 23 november 2019 @ 15:07:

[...]

Dat is helaas makkelijker gezegd dan gedaan. Ben inmiddels een jaar of 6 FO en soms ben ik een tijdje in NL en denk...ik ga eens wat (simpel maar leuk) werk doen.

Maar, dat valt enorm tegen.

Ten eerste ben je heel snel overgekwalificeerd door je eerdere carrière en is deze ervaring niet zo relevant. Of het schrikt de werkgever juist af (mondig, want overgekwalificeerd) en krijg je de raarste afwijzingen.

Ten tweede, omdat je niet hoeft te werken, heb je al snel enorme gaten in je CV. Ik moet alles bij elkaar liegen om überhaupt op gesprek te komen. Dan heb ik het niet eens over het gesprek zelf. Lange periodes van reizen, gewoon paar maanden niksen, het is alsof je van een andere planeet komt. Mensen hebben echt geen idee dat je FO kan zijn en behandelen je alsof je in de bijstand zit.

Ten derde, de sector waarin ik zat (ICT) is dusdanig conservatief dat je al snel als 'lastig' wordt gezien. Daar worden alleen full time contracten verdeeld en zitten ze niet te wachten op iemand die 2-3 dagen werkt en waar ze niet het gevoel bij hebben dat je jaren afhankelijk bent van de hand die je voedt. Stop er een paar wereldreizen of lange breaks in en je kan het helemaal wel vergeten.

Het bizarre is dat als je hetzelfde werk als vrijwilliger doet, je meteen welkom bent. Daarom eerst FO en daarna iets leuks als vrijwilliger zoeken.

Als je korte opdrachten wil, ga dan als zzper werken. Maar ook daar wil een opdrachtgever dan je een bepaalde opdracht afwerkt.

Sony A7 iv en wat recycled glas

Waarom wil je zo graag aflossen?Verwijderd schreef op zaterdag 23 november 2019 @ 19:15:

Beste FO'ers en FO'ers in wording,

Al gedurende enkele jaren lees ik mee op dit topic maar wegens tijdgebrek nooit actief deelgenomen. Nu wij eindelijk meer tijd hebben kunnen we eens goed naar onze FO ambities gaan kijken.

***members only***

Heb laatste jaren minimaal gewerkt. Ben al jaren FO, dus alleen gewerkt omdat het leuk is. Als zzp'er coder (dat is inmiddels wel wat jaren geleden) en afgelopen jaren soms jaarlijks paar maanden zzp'er als reisleider gewerkt. Coden zit ik niet meer in want saai en reisleider wil ik niet meer omdat ik al zo vaak van huis ben.Baytep schreef op zaterdag 23 november 2019 @ 21:58:

[...]

Ben je nu FO, of niet?

Dat bedrijven je als lastig ervaren is wel te verklaren als je erbij bedenkt dat het je doel is (als ik me niet vergis) om zo snel mogelijk wat WW op te bouwen en dan weer op kosten van de samenleving ergens heen te vertrekken.

Als de gaten in je CV een patroon hebben is dat snel doorzichtig

Ik wil best 6-12 maanden als barista, als vraagbaak bij de Gamma of als pakketbezorger werken. Lekker relaxte baantjes, maar je komt er als oudere ingenieur met 15+ jaar ervaring in ICT projectmanagement, security en coder, domweg niet voor in aanmerking. Mijn voorgaande 6 jaren waarin nauwelijks een CV opgebouwd is, helpt niet mee. Die paar jaar extra in een goede baan zou ik gewoon volmaken tot FO. Dat is mijn ervaring met het zoeken van een "relaxed" baantje als je FO bent, zoals iemand eerder aangaf.

Het tijdelijke werk van de mindere categorie, zoals bij een benzinepomp, kassa, vakkenvuller of callcenter, zal vast makkelijker zijn om in te rollen. Maar dan moet je wel erg graag willen werken. 😃

Dus daarom heb ik een aantal vrijwilligersplekjes gevonden waar ik een paar maanden meehelp en dan zonder problemen weer weg ben en terug kan keren. Zoals een aantal festivals en natuurprojecten. Echt zoveel leuker dan welk tijdelijk baantje dan ook! Iedereen blij!

[ Voor 12% gewijzigd door kabelmannetje op 24-11-2019 00:50 ]

Heb je dit echt allemaal gecheckt? Gaat de gemiddelde bouwmarkt echt moeilijk doen over een cv met gaten voor zo'n baantje? Pakket bezorger... Lijken mij ook geen sterke toelatingseisen op van toepassing. Wellicht wel bij UPS maar niet bij de mindere goden. Een baantje als barista (hier in Amsterdam wemelt het van de koffietentjes) lijkt me ook niet zo moeilijk, al hoewel de voorkeur wel uit lijkt te gaan naar jonge mensen. Relaxed zou ik zo'n baan trouwens niet noemen, maar dat is een ander verhaal.kabelmannetje schreef op zondag 24 november 2019 @ 00:39:

[...]

Ik wil best 6-12 maanden als barista, als vraagbaak bij de Gamma of als pakketbezorger werken. Lekker relaxte baantjes, maar je komt er als oudere ingenieur met 15+ jaar ervaring in ICT projectmanagement, security en coder, domweg niet voor in aanmerking.

Precies. Zeker als je 2 tot 4x zoveel binnenharkt per uur. Die banen zijn een eenrichtingsweg: eenmaal eruit kom je er nauwelijks meer terug in.kabelmannetje schreef op zondag 24 november 2019 @ 00:39:

Die paar jaar extra in een goede baan zou ik gewoon volmaken tot FO.

Eventueel schaal je uren terug bij een bestaande werkgever in aanloop van FIRE, maar jezelf bij voorbaat afhankelijk maken van laagbetaalde baantjes in de dienstensector is gewoon een suffe strategie.

Die hele barista-FIRE brigade op bv Reddit heeft een hoog ik-wil-ook-maar-kan-niet gehalte en houdt zichzelf voor de gek.

iPad Pro 12.9 | Sony 55A89 4K OLED Smart Android TV | Mobile: iPhone 8 Plus 64GB | Warmtepomp MHI SRC/SRK35ZS-W

Ik denk ook niet dat je dat soort type traditionele baantjes moet ambieeren als je FO bent en al lang geleden gestopt bent met het traditionele werken. Je hebt de luxe om gewoon te kunnen doen wat je wilt, dus hou je bezig met waar je passie voor hebt.kabelmannetje schreef op zaterdag 23 november 2019 @ 15:07:

[...]

Dat is helaas makkelijker gezegd dan gedaan. Ben inmiddels een jaar of 6 FO en soms ben ik een tijdje in NL en denk...ik ga eens wat (simpel maar leuk) werk doen.

Maar, dat valt enorm tegen.

Ten eerste ben je heel snel overgekwalificeerd door je eerdere carrière en is deze ervaring niet zo relevant. Of het schrikt de werkgever juist af (mondig, want overgekwalificeerd) en krijg je de raarste afwijzingen.

Ten tweede, omdat je niet hoeft te werken, heb je al snel enorme gaten in je CV. Ik moet alles bij elkaar liegen om überhaupt op gesprek te komen. Dan heb ik het niet eens over het gesprek zelf. Lange periodes van reizen, gewoon paar maanden niksen, het is alsof je van een andere planeet komt. Mensen hebben echt geen idee dat je FO kan zijn en behandelen je alsof je in de bijstand zit.

Ten derde, de sector waarin ik zat (ICT) is dusdanig conservatief dat je al snel als 'lastig' wordt gezien. Daar worden alleen full time contracten verdeeld en zitten ze niet te wachten op iemand die 2-3 dagen werkt en waar ze niet het gevoel bij hebben dat je jaren afhankelijk bent van de hand die je voedt. Stop er een paar wereldreizen of lange breaks in en je kan het helemaal wel vergeten.

Het bizarre is dat als je hetzelfde werk als vrijwilliger doet, je meteen welkom bent. Daarom eerst FO en daarna iets leuks als vrijwilliger zoeken.

Als jij thuis nog elke dag bezig bent met het hacken van de Linux kernel is er echt nog wel ergens een interessante IT positie te vinden. Of je kan gewoon bounties hunten op hackerone oid voor de lol. Maar als je zes jaar geleden de handdoek in de ring hebt gegooid wat betreft IT-werk moet je ook niet daarin verder willen. Als je thuis elke dag bezig bent met het roosteren van koffiebonen voor de perfecte cappuccino kom je echt wel aan de bak als barista, als je het geen bal interesseert in je dagelijkse leven moet je het niet doen. Als je van reizen houdt af en toe een paar maanden aan de bak als reisleider is eigenlijke het enige wat je schrijft wat wel logisch voor mij is.

Je bent FO, je hebt alle tijd om je te richten op je passies en hobbies. Als je wilt is daar vaak snel genoeg een raakvlak met iets om geld te verdienen. En als dat niet het geval is, ook prima. Je bent FO, dus je hoeft niet betaald te worden. Ook prima om gewoon onbetaald bezig te zijn met je passies en hobbies.

Verwijderd

Hypotheekvrij zijn creëert een gevoel van vrijheid en zekerheid. Bij een volgende crisis is het fijn om amper/geen maandlasten te hebben. Tevens energieneutraal met een flink overschot. Aflossen betekend netto 850 besparen per maand. Bijna alsof je van je zelf huurt..

Ik dacht juist dat optie 2 een van de veiligere was. Veel gedoe kan best, maar geen probleem. Qua onderhoud kan ik veel zelf, dus dat geloof ik wel. Huis in de randstad gebied waar vraag hoog is. Huurprijs in tijden van crisis verlagen is een optie. Enige risico is groot (onvoorzien) onderhoud. Andere risico's zijn goed/beter af te dekken naar mijn idee...HereIsTom schreef op zondag 24 november 2019 @ 12:05:

@Verwijderd Ik zou een combinatie van optie 1 en 3 doen. Optie twee is veel risico en veel werk/gedoe.

De beurs vindt ik eigenlijk gevoelsmatig het meest risicovol... Neig naar optie 2, mogelijk in combinatie met optie 1...

Ook groot onderhoud, naast je hoofdbaan? Ik besteed onderhoud zelf liever uit.. dan heb ik meer tijd om geld te verdienen met mijn echte werk. Bovendien, hoe meer je zelf doet om een huis te verhuren, hoe meer kans je hebt dat de inkomsten in box 1 vallen. En die wil je natuurlijk in box 3 houden.Verwijderd schreef op zondag 24 november 2019 @ 16:03:

[...]

Qua onderhoud kan ik veel zelf, dus dat geloof ik wel.

De huizenmarkt zit momenteel op een flinke top. Wellicht dat het nog hoger kan, maar het zou ook een zeepbel kunnen zijn die gaat knappen. Vind ik persoonlijk wel een risico om nu in vastgoed te stappen.[...] Huis in de randstad gebied waar vraag hoog is. Huurprijs in tijden van crisis verlagen is een optie. Enige risico is groot (onvoorzien) onderhoud.

Panasonic WH-MDC09J3E5, Atlantic Explorer V4 270C, 57x PV 23115 Wp

Dat is een zeer kostbaar "gevoel". Inleggen op bakstenen van je huis levert met huidige hypotheekrentes (ik neem even aan dat je die hebt) niet meer op dan de inflatie. Als je een 30-jarige periode neemt en daarin ETFs koopt, ipv eigen vastgoed, doen aandelen het aan bijna zekerheid grenzende waarschijnlijkheid, beter. Na 30 jaar braaf inleggen in ETFs, zal dit bedrag dusdanig groot zijn dat je vele jaren eerder FO kan zijn en lach je naar het bedrag dat je aan hypotheek moet betalen.Verwijderd schreef op zondag 24 november 2019 @ 16:03:

[...]

Hypotheekvrij zijn creëert een gevoel van vrijheid en zekerheid. Bij een volgende crisis is het fijn om amper/geen maandlasten te hebben. Tevens energieneutraal met een flink overschot. Aflossen betekend netto 850 besparen per maand. Bijna alsof je van je zelf huurt..

Het jarenlang aflossen op mijn woning ipv investeren in ETFs, is 1 van mijn meest kostbare beslissingen ooit geweest.

Het hebben van hypotheekschuld is juist prachtig: elk jaar "verdampt" rond 2% automatisch door de inflatie. Hoef je niks aan doen.

[ Voor 11% gewijzigd door kabelmannetje op 24-11-2019 18:35 ]

Maar voor de keuze om wel of niet extra af te lossen met het kapitaal dat je eventueel daar voor kan gebruiken maakt die inflatie juist weer geen enkel verschil. Inflatie "verdampt" ook van het kapitaal automatisch 2% elk jaar.kabelmannetje schreef op zondag 24 november 2019 @ 18:27:

[...]

Het hebben van hypotheekschuld is juist prachtig: elk jaar "verdampt" rond 2% automatisch door de inflatie. Hoef je niks aan doen.Na 30 jaar verdampen, betaal je naar koopkracht wellicht nog maar 1/3 van wat je nu betaalt.

[ Voor 10% gewijzigd door Zr40 op 24-11-2019 18:44 ]

Opbrengst 30 jaar ETFs >>>> inflatie.Zr40 schreef op zondag 24 november 2019 @ 18:40:

[...]

Maar voor de keuze om wel of niet extra af te lossen maakt die inflatie juist weer geen enkel verschil. Inflatie werkt ook op het kapitaal dat je beschikbaar hebt om mee af te lossen.

Inflatie kan je aan beide kanten wegstrepen, en dat geeft als voordeel dat je het volledig buiten beschouwing kan laten in de vergelijking "stop ik mijn beschikbare kapitaal in een ETF, of los ik de hypotheek er mee af?"

[ Voor 50% gewijzigd door Zr40 op 24-11-2019 18:55 ]

Als je nu bijv. 30% van je koopkracht aan hypotheek betaalt, betaal je over 30 jaar naar dezelfde koopkracht nog maar 10%. Dus je hebt 30 jaar lang tegen een slecht rendement ingelegd en je bespaart na 30 jaar slechts 10% van je huidige koopkracht. Dat is een slechte deal.Zr40 schreef op zondag 24 november 2019 @ 18:47:

Uiteraard. Maar het ging hier om inflatie, niet om het veel hogere rendement van ETFs ten opzichte van de hypotheekrente. Als je inflatie als voordeel ziet bij een lening, dan moet je dat ook toepassen op je kapitaal.

Je streept het aan beide kanten weg, en dat geeft als voordeel dat je het buiten beschouwing kan laten in de vergelijking "stop ik mijn beschikbare kapitaal in een ETF, of los ik de hypotheek er mee af?"

[ Voor 41% gewijzigd door kabelmannetje op 24-11-2019 18:59 ]

Als je een enkel huis / appartement verhuurt zal dat in box 3 vallen, hoeveel je ook zelf regelt. Eigenlijk ben je tot 4 pandjes wel veilig als je alles zelf regelt / onderhoudt.RichieB schreef op zondag 24 november 2019 @ 17:38:

[...]

Ook groot onderhoud, naast je hoofdbaan? Ik besteed onderhoud zelf liever uit.. dan heb ik meer tijd om geld te verdienen met mijn echte werk. Bovendien, hoe meer je zelf doet om een huis te verhuren, hoe meer kans je hebt dat de inkomsten in box 1 vallen. En die wil je natuurlijk in box 3 houden.

Daarna is het beter om de verhuur gedeeltelijk via een makelaar te laten verlopen, puur om wat papierwerk te hebben om aan te tonen dat je niet alles zelf doet.

Tja wij hebben in het verleden ook een huis verhuurt, tjonge jonge wat een ellende hebben we daar mee gehad, eerst huurders die niet betaalde en dan nog alle kosten om ze eruit te krijgen. En een stel huurders die de hele inboedel hadden verbouwd.Verwijderd schreef op zondag 24 november 2019 @ 16:03:

[...]

Hypotheekvrij zijn creëert een gevoel van vrijheid en zekerheid. Bij een volgende crisis is het fijn om amper/geen maandlasten te hebben. Tevens energieneutraal met een flink overschot. Aflossen betekend netto 850 besparen per maand. Bijna alsof je van je zelf huurt..

[...]

Ik dacht juist dat optie 2 een van de veiligere was. Veel gedoe kan best, maar geen probleem. Qua onderhoud kan ik veel zelf, dus dat geloof ik wel. Huis in de randstad gebied waar vraag hoog is. Huurprijs in tijden van crisis verlagen is een optie. Enige risico is groot (onvoorzien) onderhoud. Andere risico's zijn goed/beter af te dekken naar mijn idee...

De beurs vindt ik eigenlijk gevoelsmatig het meest risicovol... Neig naar optie 2, mogelijk in combinatie met optie 1...

Uiteindelijk heeft het ons meer slapeloze nachten en werk opgeleverd dan geld.

En in deze tijd zijn de huizenprijzen ook nog belachelijk hoog om te kopen, dus dat moet je nog maar weer terug zien te krijgen bij verkoop.

Nee extra aflossen en in ETF’s beleggen is een veel betere keus, beleggen is ook een risico, maar als je genoeg buffer hebt en extra aflost krijg je meer zekerheid.

iPad Pro 12.9 | Sony 55A89 4K OLED Smart Android TV | Mobile: iPhone 8 Plus 64GB | Warmtepomp MHI SRC/SRK35ZS-W

Mijn vriendin is ook nogal opgevoed met het mantra "beleggen kan je al je geld mee kwijtraken en sparen is goed". Wat ik wel begrijp in de tijd dat je deposito's met 5-10% rente had, dan had ik me ook gek gespaard.

Wij leggen nu dus braaf (naast de FO-pot) elke maand een extra bedrag in bij BrandNewDay onder het kopje "hypotheek aflossen in 20 jaar" met een wat defensiever risicoprofiel (50/50 en lifecycle beleggen aan) dan ik normaliter zou doen.

Over 20 jaar kijken we dan wel of we dat bedrag ook echt gaan gebruiken om de hypotheek ineens af te lossen of toch niet.

Verwijderd schreef op zaterdag 23 november 2019 @ 19:15:

Beste FO'ers en FO'ers in wording,

Al gedurende enkele jaren lees ik mee op dit topic maar wegens tijdgebrek nooit actief deelgenomen. Nu wij eindelijk meer tijd hebben kunnen we eens goed naar onze FO ambities gaan kijken.

***members only***

Het lijkt me handig om eens met je hypotheekadviseur te gaan praten over wat het je gaat kosten om je hypotheek af te betalen. Aan elke hypotheek zitten andere voorwaarden, dus misschien zijn die van jou heel gunstig.

Daarnaast kun je je dan gaan verdiepen in investeringen en kun je een rekensom maken over wat het je zou opleveren als je dat aflossingsbedrag niet in je hypotheek stopt maar investeert.

Het enige belangrijke is dat je vandaag altijd rijker bent dan gisteren. Als dat niet in centen is, dan wel in ervaring.

Als je kunt kiezen tussen 3% gegarandeerd via aflossen (bijvoorbeeld als je een hoge hypotheekrente hebt) of mogelijk 4% via beleggen, dan koos ik toch echt voor aflossen. Zeker ivm de nieuwe VRH-wetgeving straks.

Ik verbaas me er altijd over hoe hardnekkig zo'n 'wijze raad van vroeger' blijft hangen, terwijl tijden compleet veranderd zijn. Sparen (en aflossen soms ook, afhankelijk van je rente) zijn gewoon verliesgevend vandaag de dag vanwege inflatie, dus tsja wat maakt sparen dan nog 'goed' he...GG85 schreef op maandag 25 november 2019 @ 09:00:

Het blijft een interessante die "hypotheek aflossen vs EFT's".

Mijn vriendin is ook nogal opgevoed met het mantra "beleggen kan je al je geld mee kwijtraken en sparen is goed".

Misschien een klein aandachtspuntje. Je hebt het over 50/50. Waarschijnlijk dus aandelen/obligaties. Houd er rekening mee dat obligaties ook (nogal) verliesgevend zijn als de nieuwe VRH-wetgeving ingevoerd gaat worden zoals nu voorgesteld. Ik denk dat je dan toch naar 100% aandelen zult willen overstappen.

[ Voor 52% gewijzigd door de Peer op 25-11-2019 09:38 ]

Risico is er altijd. Ook als je 20k per jaar in stenen stopt. Het is voor iedereen de afweging om te bepalen welk risico je wilt nemen. Dus naast het rekensommetje is het ook van belang om af te wegen hoe waardevast de investering gaat zijn en hoe je je gaat voelen bij een dergelijke investering (kun je nog slapen?) ivm het risico.de Peer schreef op maandag 25 november 2019 @ 09:33:

@MrWilliams Ik ben het helemaal eens met je post, echter lijk je wel de factor 'risico' te vergeten. Voor veel mensen is dat terecht een showstopper. Die 4% is niet gegarandeerd en dat vindt men eng.

Als je kunt kiezen tussen 3% gegarandeerd via aflossen (bijvoorbeeld als je een hoge hypotheekrente hebt) of mogelijk 4% via beleggen, dan koos ik toch echt voor aflossen. Zeker ivm de nieuwe VRH-wetgeving straks.

[...]

Ik verbaas me er altijd over hoe hardnekkig zo'n 'wijze raad van vroeger' blijft hangen, terwijl tijden compleet veranderd zijn. Sparen (en aflossen soms ook, afhankelijk van je rente) zijn gewoon verliesgevend vandaag de dag vanwege inflatie, dus tsja wat maakt sparen dan nog 'goed' he...

Misschien een klein aandachtspuntje. Je hebt het over 50/50. Waarschijnlijk dus aandelen/obligaties. Houd er rekening mee dat obligaties ook (nogal) verliesgevend zijn als de nieuwe VRH-wetgeving ingevoerd gaat worden zoals nu voorgesteld. Ik denk dat je dan toch naar 100% aandelen zult willen overstappen.

Het enige belangrijke is dat je vandaag altijd rijker bent dan gisteren. Als dat niet in centen is, dan wel in ervaring.

Exact diezelfde grafiek heb je ook bij een aflossingsvrije hypotheek. Je stopt geen geld in stenen, je lost een lening af. Dat amateur-boekhouders dat dan anders vinden hier mag, maar je exposure aan de huizenmarkt is toch echt geheel gebaseerd op het moment waarop jij je handtekening onder het koopcontract zet.MrWilliams schreef op maandag 25 november 2019 @ 09:52:

[...]

Risico is er altijd. Ook als je 20k per jaar in stenen stopt. Het is voor iedereen de afweging om te bepalen welk risico je wilt nemen. Dus naast het rekensommetje is het ook van belang om af te wegen hoe waardevast de investering gaat zijn en hoe je je gaat voelen bij een dergelijke investering (kun je nog slapen?) ivm het risico.

Ik ben momenteel hypotheekvrij. Sowieso een lekker gevoel imo. En lekker kunnen slapen als de beurs onderuit gaat vind ik een stuk belangrijker dan wat theoretisch het maximale rendement gemiddeld genomen oplevert (ETFs met een gigantische hefboom ofzo). Nu ik zonder hypotheek zit, ga ik met mijn risicobereidheid vooralsnog eerst een tijdje 50/50 tussen sparen en aandelen doen. Dus alleen dan al lijkt het mij een inkopper dat toen ik nog een hypotheek had, ik meer op aflossen inzette dan op aandelen. Immers aflossen leverde rendement op, mijn spaargeld zo goed als nul.

Laten we zeggen 6% rendement op de beurs, 50/50 nu met spaargeld, dan levert dat dus 3% gemiddeld op. Haal nog een procent aan VRH eraf, en je zit op een wopping 2% rendement. Mijn hypotheekrente was 2.7%, met zeker tegen het einde verwaarloosbare HRA.

Wie weet ga ik later wel relatief meer beleggen als ik een groter spaarpotje heb, maar ik ga niet 100% in aandelen.

Geloof je dat de beurs toch wel eigenlijk gegarandeerd omhoog gaat, tja dan zou ik toch eens naar hefboomproducten gaan kijken.

Hefboomproducten maak je vooral de uitgever blij mee.Sissors schreef op maandag 25 november 2019 @ 10:24:

[...]

Geloof je dat de beurs toch wel eigenlijk gegarandeerd omhoog gaat, tja dan zou ik toch eens naar hefboomproducten gaan kijken.

Beleggen voor 20-30 jaar met 10-20% geleend geld (in sommige gevallen zelfs tegen negatieve rente, zie box spreads) is imo niets mis mee als je weet wat je doet.

Over geleend geld gesproken: ik heb zelf een vrij significante som geld 'geleend' met een dergelijke constructie en in een groenfonds gestopt. Op die som krijg ik een effectieve rente van 0.4% of zoiets en door het groenfonds een belastingvoordeel van +/- 1.3%.

Wat je vergeet als je zegt dat als je extra aflost ook een risico is klopt niet helemaal, want stel dat je huis over 10 jaar veel minder waard is en je nog wel meer hypotheek hebt, dat staat je huis dus ‘onderwater’, zolang de rest goed gaat niks aan de hand, maar als je aandelen dan ook nog eens veel minder waard zijn en de rentes ook nog eens flink stijgen kun je wel in de problemen komen.

Als je dan een (grotendeels) afgeloste hypotheek hebt, heb je dat risico niet.

@Longcat Nooit gehoord/geleerd van de problemen uit het verleden over beleggen met geleend geld;

https://www.care-is.nl/ni...-geleend-nooit-verstandig

[ Voor 14% gewijzigd door HereIsTom op 25-11-2019 11:49 ]

iPad Pro 12.9 | Sony 55A89 4K OLED Smart Android TV | Mobile: iPhone 8 Plus 64GB | Warmtepomp MHI SRC/SRK35ZS-W

Maar stel je hebt 30K per jaar aan uitgaven, je gaat uit van de 4% regel, dan heb je dus 25 * 30K = 750K nodig en daar werk je naar toe. Als je tegelijkertijd een hypotheek hebt van zeg 200K en de rente staat 20 jaar vast tegen 2%, dan kun je heel erg focussen op de hypotheek maar je risico profiel is dan wel een stuk anders. Maar er zijn zo veel variabelen dat dit echt heel persoonlijk is. Daarnaast speelt ook je karakter mee, waarbij je wel fijn voelt en wat niet.

Mijn eigen ervaring: in het begin is de focus vaak (terecht) op kosten naar beneden brengen, inclusief hypotheek (zeker omdat dat 5.5% was). Later als je verder bent, ga je het meer als een balans bekijken en is de hypotheek zeker een belangrijk onderdeel, maar niet meer de allerbelangrijkste en hoeft een stukje schuld, zolang het risico maar goed gemanaged is, niet perse een probleem te zijn.

Klopt. Op zich is er niks aan de hand zolang je je huis niet verkoopt. Maar wel of niet 'onder water staan' neemt niet weg dat je geen vermogen verliest mocht je verkopen. Als ik een huis koop van 400k en ik heb 200k hypotheek. (dus niet onder water) Ik los 20k af. Bij gelijk verkoopbedrag kan ik die 20k er weer uit halen. Bij verkoop voor 420k haal ik er 20k winst uit en bij verkoop voor 380k dus 0k winst. Aflossen is dus wel veilig, omdat je je huis kan blijven wonen bij geen inkomen of slechte markt. Qua vermogensopbouw nog steeds een risico.HereIsTom schreef op maandag 25 november 2019 @ 11:45:

@MrWilliams Het is precies wat @Sissors schrijft.

Wat je vergeet als je zegt dat als je extra aflost ook een risico is klopt niet helemaal, want stel dat je huis over 10 jaar veel minder waard is en je nog wel meer hypotheek hebt, dat staat je huis dus ‘onderwater’, zolang de rest goed gaat niks aan de hand, maar als je aandelen dan ook nog eens veel minder waard zijn en de rentes ook nog eens flink stijgen kun je wel in de problemen komen.

Als je dan een (grotendeels) afgeloste hypotheek hebt, heb je dat risico niet.

@Longcat Nooit gehoord/geleerd van de problemen uit het verleden over beleggen met geleend geld;

https://www.care-is.nl/ni...-geleend-nooit-verstandig

Ik ga zelf kiezen voor een andere optie om tot een lager hypotheekbedrag te komen: In een goedkoper huis gaan wonen. De overwaarde van mijn huis is zodanig, dat ik er 500m verderop een huis voor kan kopen. Hierbij ga ik er qua woongenot misschien een paar m2 op achteruit, datzelfde zal voor mijn maandbedrag gelden! Mijn schuld daalt tot 20-25% van wat het was en door de gunstige rente en de constructie kan ik dan binnen een paar jaar vrijwel hypotheekvrij zijn als ik wil.

Wellicht ook nog een optie om over na te denken...

Het enige belangrijke is dat je vandaag altijd rijker bent dan gisteren. Als dat niet in centen is, dan wel in ervaring.

Is rentestand dan lager - hoef dan natuurlijk nog maar korte periode van 2 jaar te overbruggen - moet ik minder rente betalen over totaal, maar levert de opgebouwde "spaarpot" ook minder op dus moet maandelijks meer inleggen. En andersom geldt hetzelfde.

Er zal na rentevaste periode circa 74.000 van de 80.000 inzitten heb ik even snel uitgerekend. Laatste periode dus 6.000 aan rente en resterende inleg. Als rente dan bijvoorbeeld nog maar 1% is zal ik zo'n 3.200 extra moeten inleggen in laatste 2 jaar, maar bespaar ik zelfs iets meer door lagere rente op totaal.Is de rente dan 6% dan is de spaarhypotheek na 1 jaar al vol. Bespaar ik 600 aan maandelijkse inleg laatste jaar en is het totale rentebedrag ook vergelijkbaar (veel hoger voor dat ene jaar maar slechts 1 jaar ipv 2), dus ook per saldo licht goedkoper uit.

Voor m'n gevoel is het dus prettiger om geen onzekerheid te hebben over die laatste 2 jaar, meer qua berekeningen lijkt het weinig uit te maken? Dan zal ik nu alleen wel moeten inleggen aangezien de looptijd 2 jaar korter zal zijn als ik de periode wil verkorten en ik weet niet of het dat waard is. Of zie ik iets over het hoofd, weet niet of anderen al eerder zoiets hebben gehad en wat financieel gezien de handigste keus is? Over 20 jaar is het überhaupt de vraag hoe de hypotheekmarkt dan zal zijn natuurlijk, dus ook dat is een extra kleine onzekerheid voor de resterende looptijd.

Voorop gesteld dat je je werk wel leuk vind, is er denk ik ook best veel met je laatste werkgever(s) te regelen. Bijna elke branche kent drukke en minder drukke tijden en jij hebt waarde als ingewerkte kracht. Je bent de ideale oproepkracht. Je kan het ook vormgeven in 0-uren contract of via payroll/uitzendburo, aangezien je (bijna) FO bent gaat het ook niet meer om laatste euro's er uit persen, maar meer om af en toe nog lekker bezig te zijn. Dus je hoeft niet perse ZZP top-tarief te vragen.Rukapul schreef op zondag 24 november 2019 @ 08:35:

[...]

Precies. Zeker als je 2 tot 4x zoveel binnenharkt per uur. Die banen zijn een eenrichtingsweg: eenmaal eruit kom je er nauwelijks meer terug in.

Eventueel schaal je uren terug bij een bestaande werkgever in aanloop van FIRE, maar jezelf bij voorbaat afhankelijk maken van laagbetaalde baantjes in de dienstensector is gewoon een suffe strategie.

Die hele barista-FIRE brigade op bv Reddit heeft een hoog ik-wil-ook-maar-kan-niet gehalte en houdt zichzelf voor de gek.

Op een goede manier weggaan met duidelijke uitleg wat je gaat doen, en waarom, is belangrijk zodat je later niet van alles hoeft uit te leggen. Idealiter is het omgekeerd, dat zij jou bellen als het druk is of een bepaald project langs komt en ze denken: "Miscchien heeft X wel tijd".

Vergeet je hier niet de inflatie? Dan blijft er niet zo veel meer over.Sissors schreef op maandag 25 november 2019 @ 10:24:

[...]

Laten we zeggen 6% rendement op de beurs, 50/50 nu met spaargeld, dan levert dat dus 3% gemiddeld op. Haal nog een procent aan VRH eraf, en je zit op een wopping 2% rendement.

Nee, ik doe maar wat.HereIsTom schreef op maandag 25 november 2019 @ 11:45:

@Longcat Nooit gehoord/geleerd van de problemen uit het verleden over beleggen met geleend geld;

https://www.care-is.nl/ni...-geleend-nooit-verstandig

Om wat meer details te geven over mijn geval:

- Ong. 1/3e van mijn portefeuille 'bijgeleend' (box spread) tegen een rente van -0.4% (ik krijg dus 0.4% betaald)

- Dit bedrag gestoken in een groenfonds dat mij belastingvoordeel in box 3 oplevert (+ algemene korting)

- Dit fonds beweegt over het algemeen (veel) minder dan 5% per jaar, eerder 0 tot 2%

Er zijn ook mensen die een beetje, zeg 10-20%, bijlenen tegen 1 of 2% of zo en dat steken in ETFs en degelijke. Ik zou het zelf niet doen, maar je bent dan heus niet zomaar al je geld kwijt.

Inflatie is op alles van toepassing, dus ja die negeer ik, maar ook als ik puur spaar, of puur beleg, hakt die er evenveel in.de Peer schreef op maandag 25 november 2019 @ 13:10:

[...]

Vergeet je hier niet de inflatie? Dan blijft er niet zo veel meer over.

Maar je hebt een punt in zijn algemeenheid: Zelfs met 50% van mijn vermogen belegd, is je verwachtingswaarde redelijk richting inflatiecorrectie.

Helemaal mee eens. Op het moment dat je je balans centraal stelt ga je meer als bedrijf kijken.rube schreef op maandag 25 november 2019 @ 12:15:

E.e.a. is natuurlijk erg persoonlijk en situatie afhankelijk.

Maar stel je hebt 30K per jaar aan uitgaven, je gaat uit van de 4% regel, dan heb je dus 25 * 30K = 750K nodig en daar werk je naar toe. Als je tegelijkertijd een hypotheek hebt van zeg 200K en de rente staat 20 jaar vast tegen 2%, dan kun je heel erg focussen op de hypotheek maar je risico profiel is dan wel een stuk anders. Maar er zijn zo veel variabelen dat dit echt heel persoonlijk is. Daarnaast speelt ook je karakter mee, waarbij je wel fijn voelt en wat niet.

Mijn eigen ervaring: in het begin is de focus vaak (terecht) op kosten naar beneden brengen, inclusief hypotheek (zeker omdat dat 5.5% was). Later als je verder bent, ga je het meer als een balans bekijken en is de hypotheek zeker een belangrijk onderdeel, maar niet meer de allerbelangrijkste en hoeft een stukje schuld, zolang het risico maar goed gemanaged is, niet perse een probleem te zijn.

Het is voor de meeste mensen heel aantrekkelijk dat de maandelijkse kosten van een hypotheek dalen door aflossing, maar zonder te kijken naar wat je niet krijgt. En in deze tijd speelt ook mee dat rendement ook niet automatisch naar je toe komt, dus direct en risicovrij rendement is dan makkelijk

Voor mij persoonlijk moet de leverage risicotechnisch wel redelijk zijn als het allemaal in prive gebeurt (en niet bedrijfsmatig in een BV). Iedereen zou daarvoor zijn eigen solvabiliteitsgrens kunnen opstellen als doel. Wij gaan met aankoop van een nieuwe woning stuk omhoog in hypotheek. Binnenkort eens kijken hoe dat uitpakt.

Ik ben Nederlander, 39, van nature alleenstaand

Belangrijkste verschil tussen mij en de meeste FO medereizigers, als ik het topic lees, is dat de meeste mensen al in een koopwoning zitten, terwijl ik huur -- dan wel tegen een lage semi-sociale huur, omdat ik zo'n perfide scheefhuurder ben geworden die de arme mensen het leven zuur maakt terwijl ik allang een dikke lening had moeten nemen om naar een mooie villa te verkassen, als ik het goed begrijp.

Tot zover mijn spreekbeurt, ik hoop dat het interessant was. *kijkt hoopvol naar de docent*

Dat raakt kant noch wal. Niet "dat slaat kant noch wal". Wel "dat slaat als een tang op een varken".

Je kan stellen dat zodra je een huis koopt je een blootstelling naar de vastgoed markt hebt, echter wordt dat teniet gedaan door het feit dat je een dak boven je hoofd hebt. Laten we ervan uitgaan dat je niet heel vaak verhuist dan is kopen vaak goedkoper dan huren. Het echte risico zit hem in het percentage van je maandelijkse inkomen dat deze woonlast met zich meebrengt. Als je onder de 500 euro per maand zit , zit je 220 euro onder sociale huur en dan zit je echt wel goed. Hypotheekvrij zijn is dan een dure hobby, want je dekt er aan risico niets meer mee af.

Dan sparen, hardnekkige wijsheid is dat het 'veilig' is. Welnu als de rente boven de inflatie staat is dat inderdaad het geval. Echter is dit al tijden niet meer zo. Je verliest nu gewoon ieder jaar je inflatie op je spaarbedrag. Dus moet je ieder jaar bijleggen voor je toekomstige koopkracht. Precies averechts aan je doelstelling.

Blijft over beleggen in aandelen, vastgoed voor verhuur en obligaties. Een simpele ETF is eenvoudig en levert volgens de statistieken 7% op, ben je risico avers reken dan met 5%. Daar pas je je inleg op aan en dan zit je al aardig in de richting.

Je loopt door de tijd steeds verder weg van een persoonlijk risico op financieel vlak bij een crisis. Je hoeft namelijk vaak niets of slechts een klein deel van je bezit te verkopen om eventuele inkomens of cash flow problemen tijdelijk het hoofd te bieden.

Je vermogensopbouw in de jaren dat het wel goed gaat is afdoende geweest om dit te bewerkstelligen. En na een crisis is er altijd weer een periode van herstel en gaat de opbouw ook weer door.

Kosten besparen en schulden verlagen is allemaal erg noodzakelijk en nodig zeker in het begin om je uitgave kant op orde te brengen , zodat in verhouding tot je inkomsten je steeds minder risico loopt om zonder je eerste levensbehoeftes te komen te zitten. Daarna moet de focus om en gaat het gewoon om vermogensopbouw.

Het risico zit hem dan vooral in het niet durven over te stappen , en blijven hangen in bezuinigen , en aflossen. Dit kan je zomaar jaren schelen. Of in ieder geval een paar leuke sabbaticals. Op een gegeven moment is je tijd ook gewoon op. En kun je die leuke dingen niet meer doen. En dan blijkt het risico dus ineens toch uit een niet financiele hoek te komen.

Als je liever hypotheekvrij bent, kan je beter niet voor optie 2 gaan. Heb je al eens een ruwe berekening gemaakt als je enkel voor optie 2 gaat? Zo ja, wil je die eens posten. Ben namelijk benieuwd of het resultaat uit optie 2 beter is dan uit optie 1.Verwijderd schreef op zondag 24 november 2019 @ 16:03:

Hypotheekvrij zijn creëert een gevoel van vrijheid en zekerheid. Bij een volgende crisis is het fijn om amper/geen maandlasten te hebben. Tevens energieneutraal met een flink overschot. Aflossen betekend netto 850 besparen per maand. Bijna alsof je van je zelf huurt..

Ik dacht juist dat optie 2 een van de veiligere was. Veel gedoe kan best, maar geen probleem. Qua onderhoud kan ik veel zelf, dus dat geloof ik wel. Huis in de randstad gebied waar vraag hoog is. Huurprijs in tijden van crisis verlagen is een optie. Enige risico is groot (onvoorzien) onderhoud. Andere risico's zijn goed/beter af te dekken naar mijn idee...

De beurs vindt ik eigenlijk gevoelsmatig het meest risicovol... Neig naar optie 2, mogelijk in combinatie met optie 1...

Ja -- het enige "jammere" daaraan is dat het gelijk ook saai is omdat er nog maar weinig ruimte over is voor verdere optimalisatie, en dan is geduldig wachten tot het moment daar is ook gelijk heel vervelend.rube schreef op maandag 25 november 2019 @ 21:23:

@MneoreJ klinkt alsof je lekker bezig bent. Goede savingsrate. Klinkt alsof je gewoon lekker zo door kan gaan!

Maar aangezien ik nu geld op de beurs heb hoef ik alleen maar te wachten op de volgende crisis (die volgens menigeen toch echt heel snel binnenkort gaat gebeuren nu) om het weer spannend te maken.

Dat raakt kant noch wal. Niet "dat slaat kant noch wal". Wel "dat slaat als een tang op een varken".

Het is nu al enige tijd de grote joepie-show op de beurs. Mijn portefeuille stijgt sneller dan ik ze kan verdienen met arbeid. Je zou op den duur beginnen denken dat het feestje voor altijd zal blijven duren.

Maar de correctie van bijna een jaar geleden was toch een serieuze. Ongetwijfeld komt er nog wel eens zo eentje. Of mogelijk ook een volledig jaar met negatief rendement.

Dan zijn de goede periodes weer snel vergeten, net zoals nu de slechte, en denkt men dat het zal blijven naar beneden gaan richting nul. De mens heeft nu eenmaal de neiging om trends te lineariseren.

Het wachten op een correctie kan zolang duren dat je doordat je aan de zijlijn staat al in deze bijzondere tijden van lage rentes dat de correctie op zich niet voldoende is om de schade goed te maken. En de 'correctie' van een jaar geleden was ook maar een kleine , amper 20%. Dat de waarderingen in veel gevallen scheef zitten is zeker zo.Wozmro schreef op maandag 25 november 2019 @ 21:42:

Hypotheekvrij zijn kan helpen om serieuze correcties op de beurs uit te zitten en rustig (of toch zo rustig mogelijk) af te wachten tot het weer beter gaat of zelfs de moed te hebben om net dan extra cash te gebruiken om bij te kopen.

Het is nu al enige tijd de grote joepie-show op de beurs. Mijn portefeuille stijgt sneller dan ik ze kan verdienen met arbeid. Je zou op den duur beginnen denken dat het feestje voor altijd zal blijven duren.

Maar de correctie van bijna een jaar geleden was toch een serieuze. Ongetwijfeld komt er nog wel eens zo eentje. Of mogelijk ook een volledig jaar met negatief rendement.

Dan zijn de goede periodes weer snel vergeten, net zoals nu de slechte, en denkt men dat het zal blijven naar beneden gaan richting nul. De mens heeft nu eenmaal de neiging om trends te lineariseren.

Ik geloof niet in efficiënte markten, de markt kan zolang irrationeel blijven dat je op weg omhoog zoveel mist dat dat voor een mens niet goed te maken is in de resterende tijd. Andersom kan ook, echter staat daar dan vaak dividend tegenover om de pijn te verzachten. Maar alles zou nu door de lage rente overgewaardeerd zijn, vastgoed prijzen obligaties en aandelen. Je kan dus nergens meer instappen volgens de theorie.

De lage rentes hebben een dusdanig vreemd karakter dat de gevolgen geenszins te voorspellen zijn. Voor FO en passief inkomen is de keuze niet heel anders dan simpelweg op tijd vertrouwen. De gespreide inleg dempt risico en doordat je kosten laag zijn kun je het uitzingen in mindere tijden. Je vermogen is immers in de goede tijden vele malen meer gegroeid dan je inkomen uit arbeid. Dat simpelweg gelimiteerd wordt door je tijd die je in kan ruilen voor arbeid.

Als je boven de ton verdiend zit je al in de top 2% van de inkomens, daar komen is lastig genoeg dus, statistische gezien. Je maakt dus meer kans om via vermogen je inkomen te verdienen.

Aan de kant van de besparingen houdt het eveneens snel op, je kaarten zetten op het wiskundige wonder van de groeikracht van vermogen en rente op rente is dan best een goede optie

Ik zou er niet teveel angst voor hebben om in de markt te zitten.

- wil je eerder met pensioen? ETFs

- wil je 100% zekerheid van geen hypotheeklasten? Aflossen

- Geen slapeloze nachten over wat beurs doet? Aflossen

- Wil je een huis nalaten aan kinderen? Aflossen

- Wil je vermogen nalaten aan kinderen? ETFs

- Wil je na verloop van tijd flexibel leven en is huis blok aan je been? ETFs en huis tzt verkopen.

- laat je je door ratio leiden ipv gevoel? ETFs

- Is een woning niet meer dan een woonplek? ETFs kopen

- Wil je vermogen hebben? ETFs

- Wil je geen hypotheek ipv een lage hypotheek plus vermogen? Aflossen.

- Voel je je beter bij veel vermogen dan geen vermogen maar geen hypotheek? ETFs

Persoonlijk val ik in categorie ETFs.

[ Voor 3% gewijzigd door kabelmannetje op 25-11-2019 22:17 ]

Ik heb het niet gecontroleerd, maar ervan uitgaande dat de dit de 2% klopt: dat is erg weinig. Maar als je kijkt naar absolute aantallen zijn dat toch grote groepen mensen in Nederland.CornermanNL schreef op maandag 25 november 2019 @ 22:10:

[...]

Als je boven de ton verdiend zit je al in de top 2% van de inkomens, daar komen is lastig genoeg dus, statistische gezien. Je maakt dus meer kans om via vermogen je inkomen te verdienen.

Dus ja de meeste mensen zullen het niet bereiken maar velen (absoluut gezien) wel.

Ik heb mijn salaris (uit loon) in 10 jaar zo'n beetje verdrievoudigd en zit nu ook boven de 100K. Geluk? Natuurlijk ook. Maar ook bewust kansen gepakt (en gecalculeerde risico's genomen) en hard/slim gewerkt.

Ik probeer verschillende zaken te combineren:CornermanNL schreef op maandag 25 november 2019 @ 22:10:

[...]

Het wachten op een correctie kan zolang duren dat je doordat je aan de zijlijn staat al in deze bijzondere tijden van lage rentes dat de correctie op zich niet voldoende is om de schade goed te maken. En de 'correctie' van een jaar geleden was ook maar een kleine , amper 20%. Dat de waarderingen in veel gevallen scheef zitten is zeker zo.

Ik geloof niet in efficiënte markten, de markt kan zolang irrationeel blijven dat je op weg omhoog zoveel mist dat dat voor een mens niet goed te maken is in de resterende tijd. Andersom kan ook, echter staat daar dan vaak dividend tegenover om de pijn te verzachten. Maar alles zou nu door de lage rente overgewaardeerd zijn, vastgoed prijzen obligaties en aandelen. Je kan dus nergens meer instappen volgens de theorie.

De lage rentes hebben een dusdanig vreemd karakter dat de gevolgen geenszins te voorspellen zijn. Voor FO en passief inkomen is de keuze niet heel anders dan simpelweg op tijd vertrouwen. De gespreide inleg dempt risico en doordat je kosten laag zijn kun je het uitzingen in mindere tijden. Je vermogen is immers in de goede tijden vele malen meer gegroeid dan je inkomen uit arbeid. Dat simpelweg gelimiteerd wordt door je tijd die je in kan ruilen voor arbeid.

Als je boven de ton verdiend zit je al in de top 2% van de inkomens, daar komen is lastig genoeg dus, statistische gezien. Je maakt dus meer kans om via vermogen je inkomen te verdienen.

Aan de kant van de besparingen houdt het eveneens snel op, je kaarten zetten op het wiskundige wonder van de groeikracht van vermogen en rente op rente is dan best een goede optie

Ik zou er niet teveel angst voor hebben om in de markt te zitten.

- lage vaste kosten.

- grote cashbuffer

- rente op rente effect zo goed mogelijk te

benutten door herinvesteren (dividenden, huurinkomsten, interesten).

Ik merk ook in portefeuille dat nu vwrl/iwda sterk aan het stijgen zijn tegelijk mijn defensieve holdings en nutsbedrijf het rustiger aan doen/licht dalen. Ze waren het afgelopen jaar wel al veel sterker gestegen dan vwrl/iwda die precies aan een inhaalbeweging bezig zijn.

Dus nu leg ik met mijn beschikbare cash wat meer in bij de holdings en nutsbedrijf.

Kleine kritische noot, als "tijden veranderd zijn" voor sparen/inflatie wat geeft ons dan de garantie dat hetzelfde niet geldt voor globale groei/rendement?CornermanNL schreef op maandag 25 november 2019 @ 20:42:

Dan sparen, hardnekkige wijsheid is dat het 'veilig' is. Welnu als de rente boven de inflatie staat is dat inderdaad het geval. Echter is dit al tijden niet meer zo. Je verliest nu gewoon ieder jaar je inflatie op je spaarbedrag. Dus moet je ieder jaar bijleggen voor je toekomstige koopkracht. Precies averechts aan je doelstelling.

Blijft over beleggen in aandelen, vastgoed voor verhuur en obligaties. Een simpele ETF is eenvoudig en levert volgens de statistieken 7% op, ben je risico avers reken dan met 5%. Daar pas je je inleg op aan en dan zit je al aardig in de richting.

Maar, zelfs als pessimist blijft dan de vraag wat het alternatief zou moeten zijn.

“The greatest threat to our planet is the belief that someone else will save it.” [quote by Robert Swan, OBE]

Wij hebben beide gedaan, daarom zijn we met 55 ook FOkabelmannetje schreef op maandag 25 november 2019 @ 22:16:

Voorafgaand aan de discussie ETF/aflossen zal je moeten kijken wat voor persoon je bent.

- wil je eerder met pensioen? ETFs

- wil je 100% zekerheid van geen hypotheeklasten? Aflossen

- Geen slapeloze nachten over wat beurs doet? Aflossen

- Wil je een huis nalaten aan kinderen? Aflossen

- Wil je vermogen nalaten aan kinderen? ETFs

- Wil je na verloop van tijd flexibel leven en is huis blok aan je been? ETFs en huis tzt verkopen.

- laat je je door ratio leiden ipv gevoel? ETFs

- Is een woning niet meer dan een woonplek? ETFs kopen

- Wil je vermogen hebben? ETFs

- Wil je geen hypotheek ipv een lage hypotheek plus vermogen? Aflossen.

- Voel je je beter bij veel vermogen dan geen vermogen maar geen hypotheek? ETFs

Persoonlijk val ik in categorie ETFs.

iPad Pro 12.9 | Sony 55A89 4K OLED Smart Android TV | Mobile: iPhone 8 Plus 64GB | Warmtepomp MHI SRC/SRK35ZS-W

Ik denk dat de efficiente markthypothese wel vaak opgaat, maar dat we nu gewoon in uitzonderlijk macro-economish tij verkeren, met de langdurige lage rente het bijzondere/ruime monetair beleid. Dit zorgt ook ander investeringsgedrag. Assetprijzen hebben zich hierop aangepast. Het punt is dat dit nog wel twee decennia kan aanhouden (o.a. door vergrijzing), in die zin is er op zijn minst tijdelijk een nieuwe werkelijkheid.CornermanNL schreef op maandag 25 november 2019 @ 22:10:

[...]

Het wachten op een correctie kan zolang duren dat je doordat je aan de zijlijn staat al in deze bijzondere tijden van lage rentes dat de correctie op zich niet voldoende is om de schade goed te maken. En de 'correctie' van een jaar geleden was ook maar een kleine , amper 20%. Dat de waarderingen in veel gevallen scheef zitten is zeker zo.

Ik geloof niet in efficiënte markten, de markt kan zolang irrationeel blijven dat je op weg omhoog zoveel mist dat dat voor een mens niet goed te maken is in de resterende tijd. Andersom kan ook, echter staat daar dan vaak dividend tegenover om de pijn te verzachten. Maar alles zou nu door de lage rente overgewaardeerd zijn, vastgoed prijzen obligaties en aandelen. Je kan dus nergens meer instappen volgens de theorie.

De lage rentes hebben een dusdanig vreemd karakter dat de gevolgen geenszins te voorspellen zijn. Voor FO en passief inkomen is de keuze niet heel anders dan simpelweg op tijd vertrouwen. De gespreide inleg dempt risico en doordat je kosten laag zijn kun je het uitzingen in mindere tijden. Je vermogen is immers in de goede tijden vele malen meer gegroeid dan je inkomen uit arbeid. Dat simpelweg gelimiteerd wordt door je tijd die je in kan ruilen voor arbeid.

Als je boven de ton verdiend zit je al in de top 2% van de inkomens, daar komen is lastig genoeg dus, statistische gezien. Je maakt dus meer kans om via vermogen je inkomen te verdienen.

Aan de kant van de besparingen houdt het eveneens snel op, je kaarten zetten op het wiskundige wonder van de groeikracht van vermogen en rente op rente is dan best een goede optie

Ik zou er niet teveel angst voor hebben om in de markt te zitten.

Wachten is daarom vrij problematisch en ik worstel daar ook wel een beetje mee. Ik koop wel elke maand bij, maar ik merk bij mezelf ook wel enige neiging tot uitstel en dat is onder de streep waarschijnlijk niet goed voor het rendement, maar ja, er kan een correctie komen.....

Wat betreft de 2%. Het aandeel van de NL huishoudens met bruto inkomen boven 100/k bedroeg 3,8% in 2018:

https://opendata.cbs.nl/s...ED/table?ts=1574752788669

Als je veel hoger opgeleiden om je heen hebt dan denk je wellicht dat dit aandeel hoger zou moeten liggen, maar ik doe ook vrijwilligerswerk waarbij ik mensen help met probleemissues en dan besef je dat de maatschappij een andere afspiegeling heeft. Veel mensen hebben het lastig om rond te komen. Het gros van de huishoudens zit rond 20-40/k.

Er is altijd wat om te spelen...MneoreJ schreef op maandag 25 november 2019 @ 21:30:

[...]

Ja -- het enige "jammere" daaraan is dat het gelijk ook saai is omdat er nog maar weinig ruimte over is voor verdere optimalisatie, en dan is geduldig wachten tot het moment daar is ook gelijk heel vervelend.

Als je rond een ton vrij beschikbaar hebt wordt het misschien interessant om er een tweede broker bij te doen vanwege risico spreiding. Dit houdt ook vaak een andere ETF in. (Die ABN AMRO deal ziet er wel aardig uit).

Je kan ook met een deel van je portefeuile wat gerichter gaan beleggen, in losse aandelen oid.

Als je je echt verveelt kunnen we misschien wel een tombola doen waar iedereen 1000 euro van een forum genoot naar eigen inzicht belegt. Het is bijna Sinterklaas, tijd voor lootjes trekken...

Verwijderd

Die ton depositogarantiestelsel is niet relevant voor beleggingen.Baytep schreef op dinsdag 26 november 2019 @ 09:43:

[...]

Er is altijd wat om te spelen...

Als je rond een ton vrij beschikbaar hebt wordt het misschien interessant om er een tweede broker bij te doen vanwege risico spreiding. Dit houdt ook vaak een andere ETF in. (Die ABN AMRO deal ziet er wel aardig uit).

Je kan ook met een deel van je portefeuile wat gerichter gaan beleggen, in losse aandelen oid.

Als je je echt verveelt kunnen we misschien wel een tombola doen waar iedereen 1000 euro van een forum genoot naar eigen inzicht belegt. Het is bijna Sinterklaas, tijd voor lootjes trekken...

Dat hoeft dus helemaal niet zo te zijn. Over het algemeen als je in het begin van je FO-pad een flinke crisis hebt zorgt dat ervoor dat je op een beperkt kapitaal een flink percentage verliest, maar dat je op een groter kapitaal de rit naar boven maakt.MneoreJ schreef op maandag 25 november 2019 @ 21:30:

[...]

[knip dat FO nog wat langer gaat duren... tja.)

Ui m'n hoofd wordt Lynx vrij goedkoop vanaf een ton, ook handig

Verwijderd

Meh, zie dat anders.Baytep schreef op dinsdag 26 november 2019 @ 09:59:

@Euler212 klopt, maar het blijft een mooi bedrag om over risicospreiding te gaan denken.

Ui m'n hoofd wordt Lynx vrij goedkoop vanaf een ton, ook handig

Als je je drukt maakt over het ondergaan van je broker maakt het niet uit of je 10k of 1000k er hebt staan. Op het moment dat die je vermogen "verliest" ben je 100% van je vermogen in aandelen kwijt.

Sure, 10k bijwerken is makkelijker dan 1000k, maar als je het als een risico ziet (heel klein) dat je aandelen -100% gaan door je broker, dan zou ik dat risico altijd afdekken, en niet pas arbitrair na een grens.

Boeit toch niet?Verwijderd schreef op dinsdag 26 november 2019 @ 09:47:

[...]

Die ton depositogarantiestelsel is niet relevant voor beleggingen.

Mocht er -whatever- gebeuren, is het best fijn als je vermogen danwel passieve inkomen niet volledig afhankelijk is van 1 partij.

In principe is er niks aan de hand bij bijv failissement, als je aandelen en vermogen netjes in een aparte holding staan. Maar kan dan best een paar weken of maanden stress geven, of mogelijk zelfs geen toegang tot het is overgeboekt naar een nieuwe broker. Knap vervelend als je zo'n lange periode helemaal nergens bij kunt.

Of gewoon een dagje storing, als je net bankzaken aan het regelen bent.

Eigenlijk gewoon risico spreiding, net als dat je meerdere aandelen/etf's hebt.

Verwijderd

Zeker, maar al die zaken die je noemt worden niet opeens vervelender omdat je meer dan 1 ton hebt. Die zijn bij alle bedragen vervelend.Xanaroth schreef op dinsdag 26 november 2019 @ 10:14:

[...]

Boeit toch niet?

Mocht er -whatever- gebeuren, is het best fijn als je vermogen danwel passieve inkomen niet volledig afhankelijk is van 1 partij.

In principe is er niks aan de hand bij bijv failissement, als je aandelen en vermogen netjes in een aparte holding staan. Maar kan dan best een paar weken of maanden stress geven, of mogelijk zelfs geen toegang tot het is overgeboekt naar een nieuwe broker. Knap vervelend als je zo'n lange periode helemaal nergens bij kunt.

Of gewoon een dagje storing, als je net bankzaken aan het regelen bent.

Eigenlijk gewoon risico spreiding, net als dat je meerdere aandelen/etf's hebt.

Dus als je risicospreiding wil doen kun je dat beter meteen inzetten is mijn stelling.

Ja en nee. Het blijft vervelend, maar in het begin is het enkel dat. Je bent er nog niet van afhankelijk, en als je er even niet bij kunt is het irritant en moet je wachten. Je hebt toch je salaris nog, sparen gaat gewoon door, weliswaar alvast bij de nieuwe broker, prima.Verwijderd schreef op dinsdag 26 november 2019 @ 10:16:

[...]

Zeker, maar al die zaken die je noemt worden niet opeens vervelender omdat je meer dan 1 ton hebt. Die zijn bij alle bedragen vervelend.

Dus als je risicospreiding wil doen kun je dat beter meteen inzetten is mijn stelling.

Echter de vaste maand/kwartaal kosten beginnen wel al te lopen vanaf moment dat je de rekening start, of je er gebruik van maakt of niet. Meen enige uitzondering is Binck onder het oude stelsel, en degiro.

Zou niet weten waarom je vanaf dag 1 al 25-50 euro/jaar extra wilt uitgeven als dat zomaar 0,1-1% van je vermogen is in dat stadium. Dan betaal je naar rato best wel veel voor een 'verzekering' waarvan je weet dat je die de komende 5-10 jaar nog niet nodig hebt.

[ Voor 19% gewijzigd door Xanaroth op 26-11-2019 10:23 ]

Verwijderd

Goed voor duizend euro misschien niet. Maar als je een broker hebt met percentuele kosten kun je het al snel inzetten.Xanaroth schreef op dinsdag 26 november 2019 @ 10:21:

[...]

Ja en nee. In het begin ben je er nog niet van afhankelijk, en als je er even niet bij kunt is het jammer. Je hebt toch je salaris nog. Echter de vaste maand/kwartaal kosten beginnen wel al te lopen. Meen enige uitzondering is Binck onder het oude stelsel, en degiro.

Zou niet weten waarom je vanaf dag 1 al 25-50 euro/jaar extra wilt uitgeven als dat zomaar 0,1-1% van je vermogen is in dat stadium.

Nu verwacht ik wel een berekening van iemand wat een tweede duurdere broker voor risicospreiding met het verwachte rendement over 30 jaar doet en of dat een goede verzekering is tegen de genoemde zaken. Inclusief tabellen, grafieken en verschillende inflatiescenarios.

@kabelmannetje Leuk. Heel veel van deze vragen gebruik ik bij de intake voor een financial life plan. Natuurlijk komen dan ook persoonlijkheid, geld persoonlijkheid,risicobereidheid, doelen en wensen op tafel. Wanneer dat geregeld is komen pas de financiën op tafel en gaan we samen het financieel plan maken.kabelmannetje schreef op maandag 25 november 2019 @ 22:16:

Voorafgaand aan de discussie ETF/aflossen zal je moeten kijken wat voor persoon je bent.

- wil je eerder met pensioen? ETFs

- wil je 100% zekerheid van geen hypotheeklasten? Aflossen

- Geen slapeloze nachten over wat beurs doet? Aflossen

- Wil je een huis nalaten aan kinderen? Aflossen

- Wil je vermogen nalaten aan kinderen? ETFs

- Wil je na verloop van tijd flexibel leven en is huis blok aan je been? ETFs en huis tzt verkopen.

- laat je je door ratio leiden ipv gevoel? ETFs

- Is een woning niet meer dan een woonplek? ETFs kopen

- Wil je vermogen hebben? ETFs

- Wil je geen hypotheek ipv een lage hypotheek plus vermogen? Aflossen.

- Voel je je beter bij veel vermogen dan geen vermogen maar geen hypotheek? ETFs

Persoonlijk val ik in categorie ETFs.

The best investment is in yourself (Warren Buffett), www.sciplan.nl, ELGA, 23 PV-panelen Oost-West

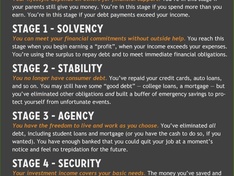

Heb een tijdje geleden een leuk plaatje gevonden op Instagram wat toepasselijk is voor dit topic en wat ik zelf gebruik.

Ben zelf met FO bezig sinds mijn 18e levensjaar. Mijn doel was op mijn 40e Stage 5 (FO) behalen.

Had wel een aantal principes voor mezelf opgesteld:

1. Huis / Appartement bezitten in Nederland, volledig afbetaald en in de verhuur wat een redelijk basis bedrag per maand kan opbrengen

2. Genoeg spaargeld om tot mijn 67e levensjaar een prima levensstijl (met niet teveel gekke wensen) erop na te houden totdat mijn pensioen zou worden uitbetaald.

3. Deel van mijn spaargeld in beleggingen / Zwitsers tax free pensioen (Dritte Säule) / crypto

4. Geen kinderen en geen vrouw met vele wensen...

5. Vanaf mijn 40e gaan verkassen naar een tropische bestemming waar mijn levens onderhoudskosten tot mijn 67e levensjaar betaalbaar zijn met de inkomsten van mijn huis en spaarpot. En de hele dag niets anders doen dan duiken en relaxen,..

Toen ik ouder werd veranderde mijn levens situatie drastisch alsook de landen waar ik heb gewoond en gewerkt. Goede bijkomstigheid is dat mijn salaris bij ieder nieuw avontuur in een ander land een leuke boost kreeg.

De punten 1 t/m 3 zijn vervuld. punt 4 was lastig daar ik altijd van gezelschap gehouden heb en ik voor de bijl ging met een lieve vrouw die vele wensen had. Na een dure scheiding, weer verder gegaan met het leven en het FO doel, maar toen kwamen er lieve dure vriendinnen. Het kinder avontuur heb ik mij nooit aan gewaagd.

Gelukkig heb ik wat financiële meevallers gehad in mijn leven, door goede investeringen (beleggingen in bedrijven) en de crypto hype waardoor ik zelfs voor mijn 40e het FO doel behaald had.

Toen een lieve vrouw met weinig wensen ontmoet in het land waar ik momenteel woon (Zwitserland), waardoor de FO principe lijst punten 4 en 5 weer in de ijskast kunnen.

Apple, AP, Porsche, Rolex & Panerai

@assje Als je wat meer wilt weten over de markten en bubbles. Een leuk boek is:assje schreef op maandag 25 november 2019 @ 23:33:

[...]

Kleine kritische noot, als "tijden veranderd zijn" voor sparen/inflatie wat geeft ons dan de garantie dat hetzelfde niet geldt voor globale groei/rendement?

Maar, zelfs als pessimist blijft dan de vraag wat het alternatief zou moeten zijn.

This Time Is Different

Eight Centuries of Financial Folly

by Carmen M. Reinhart & Kenneth S. Rogoff

Princeton University Press © 2009

Takeaways:

• The central bankers, policy makers and investors involved in every financial bubble

are utterly convinced that, in terms of economic events, “this time is different.”

• Otherwise-savvy people ignore the telltale signs of a bubble when they are in the

grasp of “this-time-is-different syndrome.”

• Even brilliant thinkers like former Federal Reserve Chairman Alan Greenspan fall

victim to this syndrome.

• Bankers and economists in the ’20s predicted that wars would not recur and the

future would be stable.

• From 2003 to 2007, conventional wisdom said central bankers’ expertise and Wall

Street innovations justified soaring home prices and rising household debt.

• In fact, rising home prices and financial innovation are strong indicators of a bubble.

• Currency debasement was common for centuries. In the past 100 years, inflation

has replaced debasement.

• Sovereign defaults are a normal part of global capitalism, although they ebb and flow.

• Financial crises have occurred regularly over the past two centuries.

• To avoid future bubbles, bankers and economists should use an early-warning

system and a stricter regulatory scheme

The best investment is in yourself (Warren Buffett), www.sciplan.nl, ELGA, 23 PV-panelen Oost-West

Dat klopt natuurlijk, maar aan de andere kant is door mijn hoge SR het pad naar FO ook weer niet zó lang. Een crisis van voldoende omvang zou dus wel degelijk voor voelbare vertraging kunnen zorgen, ook al kom ik er netto aan het eind beter uit. Ik verwacht overigens wel dat die neerval eerder vroeger dan later zal zijn met het huidige klimaat, maar dat blijft natuurlijk in een glazen bol kijken. Voor hetzelfde geld houden we dit tempo gewoon nog lekker wat jaartjes vol, om dan op het voor mij meest ongunstige moment te klappen. Ik denk dat het niet heel erg doemdenken is om die kans redelijk te noemen.R.van.M schreef op dinsdag 26 november 2019 @ 09:59:

Dat hoeft dus helemaal niet zo te zijn. Over het algemeen als je in het begin van je FO-pad een flinke crisis hebt zorgt dat ervoor dat je op een beperkt kapitaal een flink percentage verliest, maar dat je op een groter kapitaal de rit naar boven maakt.

Die "verveling" is vooral een luxeprobleem; ik verveel me ook weer niet zo erg dat ik de tijd en moeite erin wil steken om een actieve belegger te worden. Ik snap wel dat andere mensen daar een kick van krijgen, maar om goede winsten te maken en je daar ook goed bij te voelen (m.a.w. zien dat het kunde is en niet toeval) moet je echt heel behoorlijk je best doen, heb ik de indruk. Komt nog het risico bij van het zó leuk vinden dat je je FO in gevaar brengt op zoek naar de hogere winsten, wat bij andere hobby's niet speelt. Gewoon geld ergens in steken om te kijken of het toevallig leuk is heb ik in het verleden al genoeg gedaan; van die mindset ben ik inmiddels wel genezen. Vandaar ook FO...Baytep schreef op dinsdag 26 november 2019 @ 09:43:

Je kan ook met een deel van je portefeuile wat gerichter gaan beleggen, in losse aandelen oid.

Ik zit nu bij DeGiro (wegens geen kosten voor de kernselectie plus toch nog de vrijheid om met je portefeuille te experimenteren, wat ik in het begin ook wel gedaan heb). Het risico van de broker die verdwijnt en het tegoed dat een tijd lang onbereikbaar is zou ik makkelijk kunnen opvangen met mijn spaarbuffer, tenzij idd heel het bedrag opeens permanent foetsie zou zijn. Ik zou dan echter eerder geneigd zijn om tijd en moeite te steken in uitzoeken hoe reëel dat is en overstappen op een andere aanbieder als er donkere wolken zijn dan proactief meerdere aan te houden. Ik bedoel, ga je dan bij iedere ton een nieuwe zoeken "just in case" of is twee dan wel veilig genoeg?Als je rond een ton vrij beschikbaar hebt wordt het misschien interessant om er een tweede broker bij te doen vanwege risico spreiding. Dit houdt ook vaak een andere ETF in. (Die ABN AMRO deal ziet er wel aardig uit).

Dit dus, laat maar zien dat het de moeite waard is.Verwijderd schreef op dinsdag 26 november 2019 @ 10:24:

Nu verwacht ik wel een berekening van iemand wat een tweede duurdere broker voor risicospreiding met het verwachte rendement over 30 jaar doet en of dat een goede verzekering is tegen de genoemde zaken. Inclusief tabellen, grafieken en verschillende inflatiescenarios.

Dat raakt kant noch wal. Niet "dat slaat kant noch wal". Wel "dat slaat als een tang op een varken".

Tja ik ben me volledig bewust dat ik volledig voldoe aan het genoemde stereotype maar ik sluit niet uit dat 'this time different is'.crosscarver schreef op dinsdag 26 november 2019 @ 11:30:

“this time is different.”

Het is mijn inziens wel voor het eerst dat we tegen de beperkingen van onze aardbol aan gaan lopen en er daardoor grenzen aan de groei zijn. Natuurlijk kan het dat we door technologische ontwikkelingen al onze energieproblemen op gaan lossen maar ik ben nog niet overtuigd dat groei van consumptie houdbaar is.

“The greatest threat to our planet is the belief that someone else will save it.” [quote by Robert Swan, OBE]

Het is geen kwestie van enkel energiebehoefte welke te groot is.assje schreef op dinsdag 26 november 2019 @ 11:48:

[...]

Tja ik ben me volledig bewust dat ik volledig voldoe aan het genoemde stereotype maar ik sluit niet uit dat 'this time different is'.

Het is mijn inziens wel voor het eerst dat we tegen de beperkingen van onze aardbol aan gaan lopen en er daardoor grenzen aan de groei zijn. Natuurlijk kan het dat we door technologische ontwikkelingen al onze energieproblemen op gaan lossen maar ik ben nog niet overtuigd dat groei van consumptie houdbaar is.

Uitputting van diverse grondstoffen en vernietiging van onze leefomgeving in het algemeen zullen er voor zorgen dat economische groei op de klippen gaat lopen.

Het leuke van het boek is dat het je een terugblik geeft op alle tijden waarin er gezegd werd "this time it is different" bij crashes en bij bubbles. Uiteindelijk blijft alles bij hetzelfde en is er een gestaag klimmende (aandelen)markt (als je het op langere termijn bekijkt)assje schreef op dinsdag 26 november 2019 @ 11:48:

[...]

Tja ik ben me volledig bewust dat ik volledig voldoe aan het genoemde stereotype maar ik sluit niet uit dat 'this time different is'.

Het is mijn inziens wel voor het eerst dat we tegen de beperkingen van onze aardbol aan gaan lopen en er daardoor grenzen aan de groei zijn. Natuurlijk kan het dat we door technologische ontwikkelingen al onze energieproblemen op gaan lossen maar ik ben nog niet overtuigd dat groei van consumptie houdbaar is.

Daarom is buy and hold met een goede assetallocatie en deze goed herbalanceren bij crashes en bubbles ook een zo krachtige strategie.

Wanneer het echt deze keer anders is. Dan is het ook voor iedereen anders, dan kun je altijd nog de rolluiken sluiten en investeren in honkbalknuppels, zakken rijst, verbandmaterial, munitie etc. Echter de geschiedenis leert dat het meestal wel losloopt met de deze keer is het anders profeten.

Wat betreft onze aardol ben ik als wetenschapper een technologie optimist. Ook daar geld dat er vele voorspellingen al zijn gedaan dat de groei ooit zal afzwakken, het milieu/klimaat in elkaar zal storten etc. Peakoil, Club van Rome, zure regen, ozongaten, climate change etc. Ik denk dat er perfect nog groei mogelijk is. Ik kom vaker in india en daar zijn er nog hele volksstammen die uit de armoede kunnen groeien. Dat is heel iets anders dan hier in europa--> het museum van de wereld

Wanneer het deze keer toch anders is en er geen groei meer mogelijk is dan is het in ieder geval hier in europa klagen op hoog niveau.

The best investment is in yourself (Warren Buffett), www.sciplan.nl, ELGA, 23 PV-panelen Oost-West

Dat dit economisch mogelijk is zijn we het wel over eens, ik betwijfel alleen of het ecologisch mogelijk is.crosscarver schreef op dinsdag 26 november 2019 @ 12:21:

Ik denk dat er perfect nog groei mogelijk is.

“The greatest threat to our planet is the belief that someone else will save it.” [quote by Robert Swan, OBE]

Bij "this time is different" denk ik eerder aan wat sommigen de ETF bubbel noemen... Zolang het goed gaat blijft iedereen roepen dat het een totaal onschuldig product is, maar ik kan me wel enigszins vinden in de argumenten van die Michael Burry.assje schreef op dinsdag 26 november 2019 @ 11:48:

[...]

Tja ik ben me volledig bewust dat ik volledig voldoe aan het genoemde stereotype maar ik sluit niet uit dat 'this time different is'.

Het is mijn inziens wel voor het eerst dat we tegen de beperkingen van onze aardbol aan gaan lopen en er daardoor grenzen aan de groei zijn. Natuurlijk kan het dat we door technologische ontwikkelingen al onze energieproblemen op gaan lossen maar ik ben nog niet overtuigd dat groei van consumptie houdbaar is.

Over globale schaarste: We roepen al sinds de jaren 70 dat er een tekort dreigt aan vanalles en nog wat, maar blijkbaar weten we dat al 50 jaar prima te managen. Ik verwacht dat we dat nog zeker 50 jaar kunnen volhouden.

Wat ik me wel kan indenken dat de overbevolking e.e.a. teweeg brengt. Dit voornamelijk getuige de vele (en toenemende) protesten die er de afgelopen tijd gehouden worden. Door de huidige sociaal-economische inrichting (alles is altijd beschikbaar, iedereen kan met iedereen communiceren) verandert er blijkbaar iets in het paradigma waardoor het huidige politiek-maatschappelijke landschap op instorten staat.

Het enige belangrijke is dat je vandaag altijd rijker bent dan gisteren. Als dat niet in centen is, dan wel in ervaring.

Als je zegt dat je betwijfelt of het ecologisch mogelijk is. Komt dat doordat je visies hebt van enorme temperatuurverhogingen, grondstoffen schaarste, klimaat vluchtelingen etc?assje schreef op dinsdag 26 november 2019 @ 12:48:

[...]

Dat dit economisch mogelijk is zijn we het wel over eens, ik betwijfel alleen of het ecologisch mogelijk is.

Zelf denk ik dat de economische groei er sowiso gaat komen. Dat is de aard van het (menselijke) "beestje". De ecologie zal dan volgen, de mens past zijn leefomgeving al eeuwen lang aan (met technologie).

The best investment is in yourself (Warren Buffett), www.sciplan.nl, ELGA, 23 PV-panelen Oost-West

Ik denk dat het grootste gevaar voor de wereld zoals we die kennen de mensheid zelf is. Wetmatigheden als eeuwig durende groei worden beperkt door de zwakste schakel. Ik vrees dat dat overbevolking zal zijn. Ongeacht of je denkt in klimaatcrisis of van mening bent dat het allemaal zo'n vaart niet loopt, zullen we zuinig moeten zijn op onze leefomgeving. Als je dan ziet hoe wij in het 'Westen' al met onze aarde om zijn gegaan, dan vrees ik voor het moment dat alle opkomende economieën hetzelfde gaan doen. De aarde wordt steeds verder uitgeput. We zijn gewoon met te veel.

Hoe dat dan te rijmen met FO? Ik denk dat FO sowieso een egoïstisch traject is. Door keuzes probeer je ervoor te zorgen dat jij en je naasten het net iets beter hebben dan de rest. Met dat egoïsme heb ík geen moeite. Als er straks ergens een plaag uitbreekt die de helft van de wereldbevolking doodt, dan hoop ik ook dat dat aan de andere kant van de wereld is. Survival of the fittest (of luckiest).

De vraag is alleen of de keuzes die je nu maakt op basis van de huidige wetmatigheden, over 20 jaar nog steeds standhouden. En over 40 jaar nog. Geen idee. Geen idee ook of onze kinderen of kleinkinderen tegen grenzen aan gaan lopen die wij nu nog niet voor mogelijk houden. Vast. Maar ik laat me niet remmen door doemscenario's. Ik zet in op een bepaalde weg richting FO en als het nodig is, dan stuur ik bij. Misschien is FO over 30 jaar wel een huisje met een een klein lapje grond waar groenten op staan en kippen op lopen. Who knows?

Verwijderd

| Streven naar FO | Niet streven naar FO | |

| Economie gaat er aan (anarchie, wordt waarschijnlijk doodgeknuppeld voor een blik bonen) | infinite loss | infinite loss |

| Economie groeit lekker door | finite gain | no loss nor gain |

| Economie stagneert | no loss nor gain | no loss nor gain |

| Economie krimpt | finite monetary loss | no loss nor gain |

Ja ik weet dat dit te kort door de bocht is en er meer scenarios zijn.

[ Voor 19% gewijzigd door Verwijderd op 26-11-2019 14:02 ]

Er zijn veel stemmen die zeggen dat de wereld bevolking zal groeien van 7.6 in 2017, 8,6 in 2030, naar 9,8 in 2050 en uiteindelijk 11,2 miljard in 2100. Het is alleen gebaseerd op een model van vroeger die geen rekening houdt met de aanpassingen in de demografie en het geboortecijfer.

Er zijn namelijk stemmen die zeggen dat de wereld niet zal groeien in bevolking maar juist zal krimpen. Met name de vruchtbaarheidscijfers van de diverse landen in de wereld zijn veelal onder de 2. Dit is het getal die zorgt voor tenminste de vervanging van de bevolking. (2 kinderen per vrouw) dus komt dus neer op een krimp van de bevolking.

Fertility rate:

- EU 1.6

- China 1.6

- India 2.2

- Japan 1.4

- Brazil 1.8

- USA 1.9

- Canada 1.6

- Kenia 3.8

Gold is the money of kings, silver is the money of gentlemen, barter is the money of peasants – but debt is the money of slaves

Relatief gezien een detail, maar het moet zelfs iets meer dan 2 zijn (ik zie vaak 2.1 genoemd worden, maar heb daar geen bron van) omdat niet iedere vrouw kinderen wil, kan krijgen, of de leeftijd haalt waarop dat uberhaupt zou kunnen. Klinkt een beetje cru, maar dat is statistiek voor je.Lud0v1c schreef op dinsdag 26 november 2019 @ 14:00:

Met name de vruchtbaarheidscijfers van de diverse landen in de wereld zijn veelal onder de 2. Dit is het getal die zorgt voor tenminste de vervanging van de bevolking. (2 kinderen per vrouw) dus komt dus neer op een krimp van de bevolking.

Ik sluit me eerder aan bij het volgende: "This passive bubble talk is silly. Wake me up when index funds control 90% of the stock market." (Dat is nu 15%, zoals aangestipt op een andere plek in dat artikel.) Qua transparantie van functioneren en de gevolgen in gedrag van investeerders (perverse incentives) zit er ook een wereld van verschil tussen CDO's en indexfondsen. Laat niet af dat de boel in de gaten houden een goed idee blijft -- wanneer ETF's inderdaad naar 90% van de markt gaan wordt het een fundamenteel ander verhaal -- maar vooralsnog klinkt het argument meer als "populair dus bubbel". Als je je hier echt druk over maakt kun je natuurlijk meegaan in Burry's idee om te gaan investeren in small caps in plaats van of naast de indexbeleggingen. Of gewoon volledig actief gaan beleggen -- dat is ook nog steeds onverminderd populair, maar dat is dan weer geen bubbel.MrWilliams schreef op dinsdag 26 november 2019 @ 12:55:

Bij "this time is different" denk ik eerder aan wat sommigen de ETF bubbel noemen... Zolang het goed gaat blijft iedereen roepen dat het een totaal onschuldig product is, maar ik kan me wel enigszins vinden in de argumenten van die Michael Burry.

Ik zou dit iets willen nuanceren. Mijn doelstelling is helemaal niet om het beter te hebben dan wie dan ook, alleen om het goed genoeg te hebben. Of dit nu beter of slechter uitpakt dan mijn omgeving is relatief; in NL economische termen zal ik waarschijnlijk "arm" genoemd mogen worden als ik FO ben, als je kijkt naar wat ik uitgeef. Maar zoals we allemaal weten is puur naar het kostenplaatje kijken heel erg misleidend omdat het gaat om de voldoening die je eruit haalt, en als je het globaal bekijkt ben ik dan natuurlijk sowieso nog steeds stinkend rijk, wat bijna niet anders kan als je in Nederland woont.coelho schreef op dinsdag 26 november 2019 @ 13:42:

Hoe dat dan te rijmen met FO? Ik denk dat FO sowieso een egoïstisch traject is. Door keuzes probeer je ervoor te zorgen dat jij en je naasten het net iets beter hebben dan de rest.

Wel ben ik het eens met de stelling dat dit egoïstisch is, in de zin dat ik mijn gespaarde kapitaal ook weg zou kunnen geven aan de minst bedeelden op deze aardkloot, of (nog beter) gewoon mijn leven lang zou kunnen blijven werken om al dat "overbodige geld" te doneren aan het goede doel. Het is een bewuste keuze voor mij om dat niet te doen, niet omdat ik een hekel heb aan de rest van de mensheid maar omdat ik niet veel vertrouwen heb in ons vermogen als geheel om er iets moois van te maken, en ik me liever geheel afzijdig hou. Ik probeer op lokale schaal zoveel mogelijk "niet bij te dragen aan het probleem" (als ik door een voor mij simpele wijziging een positieve bijdrage kan leveren doe ik dat, zoals geen vlees eten), maar ik ga niet actief de boer op voor de betere wereld. Ik vel dan ook weer niet zo snel een oordeel over de keuzes van andere mensen op dit vlak, en als ik het helemaal bij het verkeerde eind heb is dat ook alleen maar mooi.

Dat raakt kant noch wal. Niet "dat slaat kant noch wal". Wel "dat slaat als een tang op een varken".